How the excess balance amount in cash ledger paid wrongly through challan will be refunded

It's been almost five and a half month since GST has been implemented and still, we are in the stage of the returns cycle for the month of July. However, GSTR3B is being filed every month by taxpayers to dispose of their tax liability. Since the system is new and has ironically, got more complex day by day for the taxpayers, there has been a number of mistakes committed while filing the returns and making payment. Most of these mistakes are not in a position of being rectified in today's date.

Although Past penalties have been removed and future penalty has been waived to a considerable amount, still there are many assessees whose previous returns could not be filed due to the furnishing of wrong information by mistake. Since no option of revising return is there(except for the month of July), GST system today is like once anything furnished, its written in stone.

One of the most common mistakes committed by many is payment of the amount in the wrong head of challan i.e. Suppose the liability arising was that of CGST + SGST, but by mistake, the challan was created for the amount in IGST head. Although, by law it is allowed that the Input Tax Credit of IGST can be utilised against the outward liability of CGST and SGST, but when payment has to be done through cash ledger, GST portal mandates that the challan should be created with the amount in the same head as which belong to the liability to be disposed. So, unlike in case of Input Tax Credit, the amount paid through challan cannot be cross-utilized.

There have been many instances wherein, huge outward tax liability was arising and mistakenly the incorrect challan was created. This resulted in blockage of funds, as now the business might not be in the position of making double payment and also no refund mechanism was in process. Also, due to this many taxpayers were not able to file a return for the particular month in which such mistake was committed and thereof consequently the returns for the further periods were also not furnished. Although, in many cases, the amount was twice paid by dealers and since then they have been carrying the balance in their cash ledger waiting for the refund.

So here the question which traders have been constantly asking is how to claim the refund of such amount paid incorrectly in challan??

Section 49 (6), provides for the refund of the balance in electronic cash ledger. Section 49(6) reads as:

The balance in the electronic cash ledger or electronic credit ledger after payment of tax, interest, penalty, fee or any other amount payable under this Act or the rules made thereunder may be refunded in accordance with the provisions of section 54.

Section 54 and Rule 89 of Central Goods and Services Tax (CGST) Rules, 2017, provides that any claim for refund relating to the balance in electronic cash ledger may be made through the return furnished for the relevant tax period in FORM GSTR-3 or Form GSTR-4 or Form GSTR-7 as the case may be.

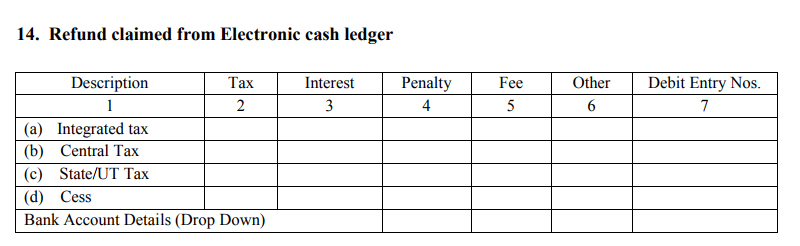

So, You can claim a refund in GSTR3 if you have any balance in cash ledger provided you are not registered in Composition Scheme. Table 14 in GSTR3 facilitates this option.

Table 14 - GSTR3

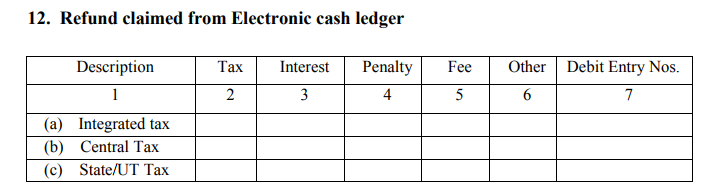

The balance in cash ledger can be claimed for a refund in GSTR4 if a person is registered under Composition Scheme. A claim can be made in Table 12 of GSTR-4.

Table 12 - GSTR4

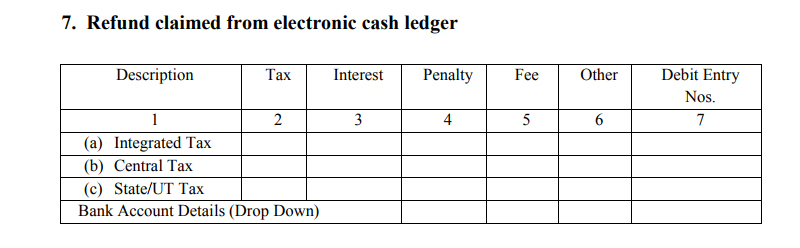

Refund in respect of TDS can be claimed in GSTR7. However, as still, the provisions are not applicable, it cannot be said that how the mechanism will work. However, table 7 of GSTR7 provides for the refund:

So, taxpayers will be able to claim the refund when they will file their GSTR-3 or GSTR-4 as the case may be. For claiming refund the return has to be filed and for that, the pending liability has to be set-off first by paying the amount so that return can be successfully filed and refund can be claimed.

GSTR3 for the month of July shall be enabled from 1st December. However, in the recent 23rd GST council meeting, it was decided that the time period for filing GSTR2 and GSTR3 for the month of July shall be worked out and given a second thought as the government has been lacking the timelines and till now we are in the cycle of filing returns for July month only. So, whether GSTR3 will be available or not is uncertain to say as of now.

Leave a Reply