Archives for 2017 - Page 13

GST Slab rationalisation will depend on rise in revenue collection

As reported by The Indian Express, Arjun Ram Meghwal, Union Minister of State in Finance and Corporate Affairs, said that Rationalisation of tax slabs under GST would depend on the rise in…

Clarifications in relation to furnishing of Bond/LUT for exports

Circular has been issued by CBEC to clarify the issues in relation to furnishing of Bond/Letter of Undertaking for Exports. Circular mentions that varied interpretation have been received from exporters…

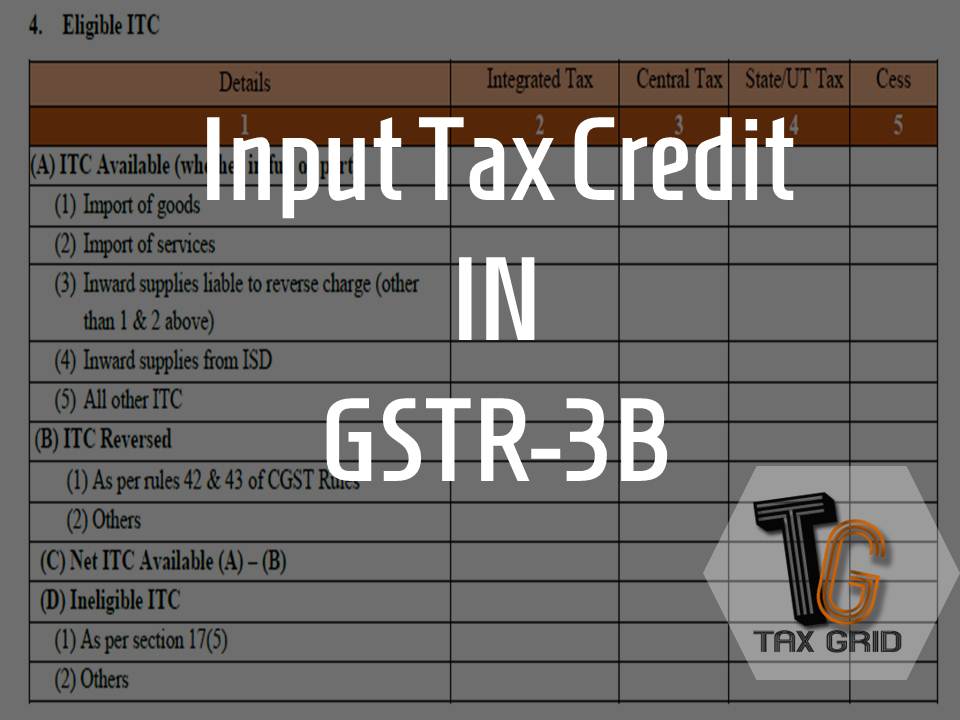

ITC under form GSTR-3B

It's time to file GSTR-3B soon and the taxpayers are getting confused as to how they can avail Input Tax Credit (ITC) in Return GSTR-3B. Another question because of which…

Continuation of Pre-GST rates of Rebate of State Levies

Circular has been issued by CBEC stating the continuation of pre-GST rates of Rebate of State Levies (ROSL) for transition period of three months to for Export of Garments and…

Sectoral booklet for E-Commerce released by CBEC

CBEC has released a booklet relevant to E-commerce industry, which contains various Frequently Asked Questions (FAQs). Read the booklet issued below: Sectoral booklet for Mining released by CBEC Decisions taken…

Sectoral booklet for Mining released by CBEC

CBEC has released a booklet relevant to industries engaged in Mining, which contains various Frequently Asked Questions (FAQs). Read the booklet issued below: Decisions taken on Services at 20th GST…

first CSC GST Suvidha Kendra launched

Ravi Shankar Prasad, Minister of Law & Justice and Minister of Electronics & Information Technology, today tweeted about the launch of first CSC (Common Services Centres) GST Suvidha Kendra. This…

FAQs in relation to GSTR-3B return filing

It is more than month now that GST has been implemented and people have been struggling with the new law. Also the confusion is getting worse as the date of return…

Maximum Ceiling of Cess Leviable on Motor Vehicles can be increased from 15% to 25%

GST Council Recommends Increase in Maximum Ceiling of Cess Leviable on Motor Vehicles Falling Under Headings 8702 and 8703 to 25% Instead of Present 15% PIB The GST Council considered…

Decisions taken on Services at 20th GST Council Meeting on 5 August, 2017

The Goods and Services Tax (GST) Council 20th Meeting was held on 5 August 2017 wherein Anti-Profiteering clause was discussed and also it was decided to implement E-way bill from…