Archives for 2017 - Page 3

Applicability of IGST / GST on goods transferred / sold while being deposited in a warehouse

Circular has been issued by CBEC regarding Applicability of IGST / GST on goods transferred / sold while being deposited in awarehouse. Read the circular below:

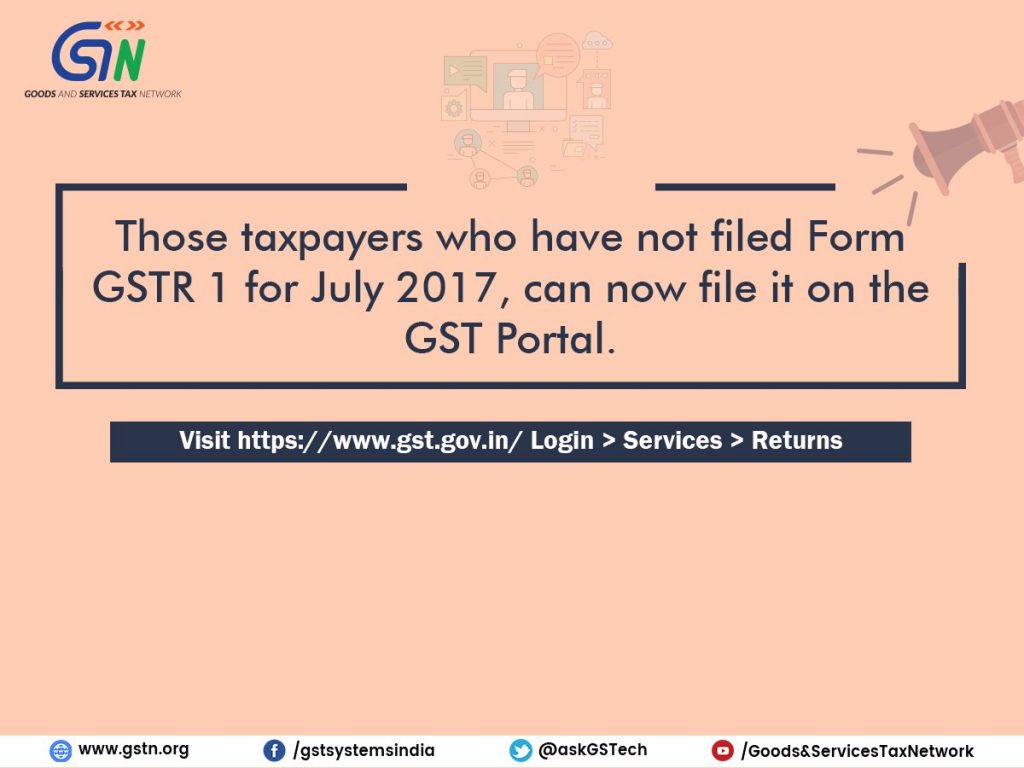

GSTR1 for July re-enable on GST portal

Taxpayers who have not filed Form GSTR 1 for July 2017, can now file it on the GST Portal.

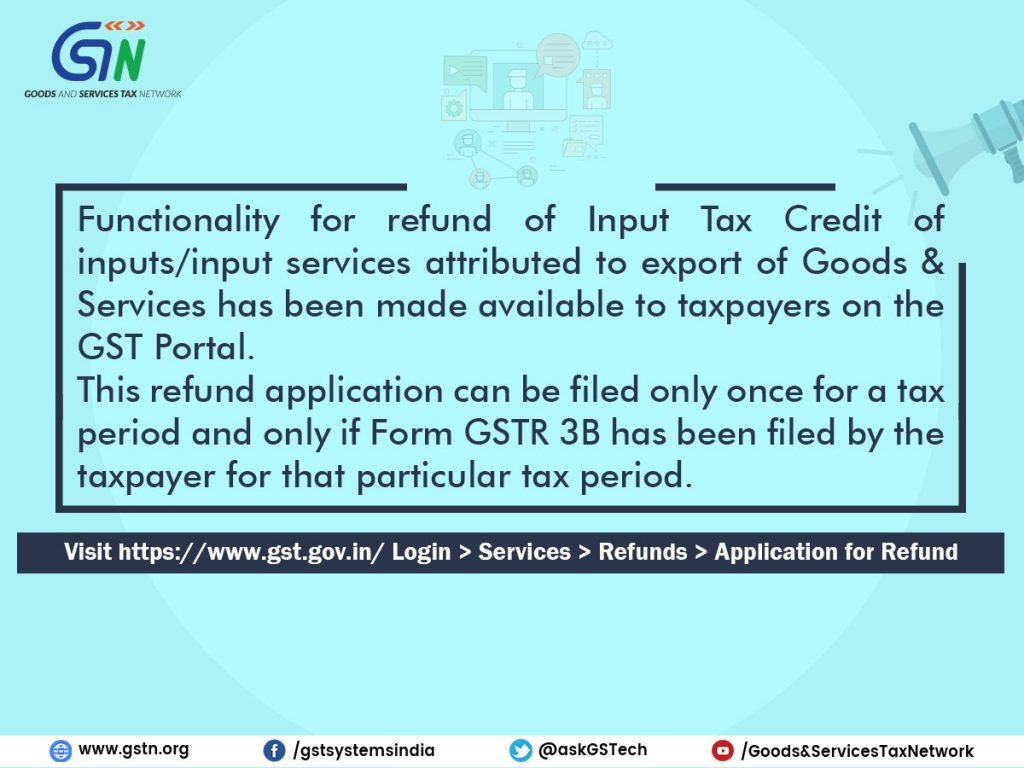

Functionality for refund of Input Tax Credit of inputs/input services attributed to export of Goods & Services is now available on the GST Portal

Functionality for refund of Input Tax Credit of inputs/input services attributed to export of Goods & Services is now available on the GST Portal.

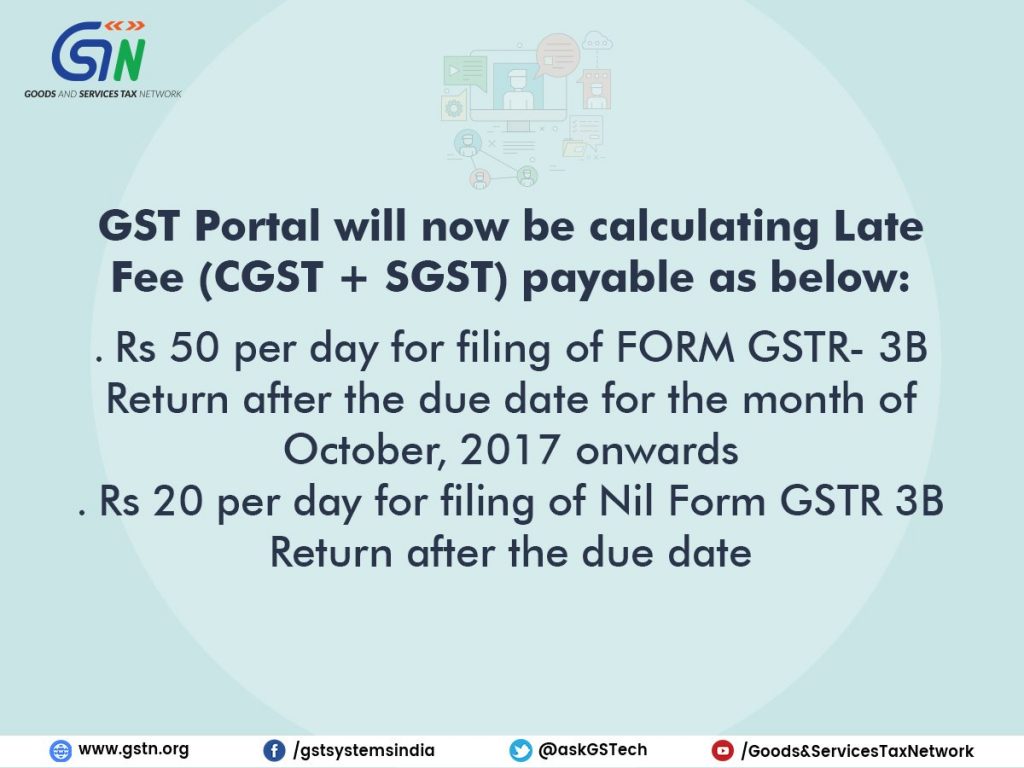

Amended Late fee amount gets active on GST portal

Recently the GST late fee amount was amended by GST council, but taxpayers were facing the issue of the same old late fee structure, as the required technical amendments were…

There might be GST rate cut on white goods making refrigerators, washing machines cheaper

After a reduction in GST rate on 178 items, another round of GST rate cut is being expected to lower the burden on White goods such as refrigerators and washing…

Establishment of National Anti-profiteering Authority under GST

Cabinet approves the establishment of the National Anti-profiteering Authority under GST PIB- (Release ID :173564) : The Union Cabinet chaired by the Prime Minister Narendra Modi has given its approval for…

How the excess balance amount in cash ledger paid wrongly through challan will be refunded

It's been almost five and a half month since GST has been implemented and still, we are in the stage of the returns cycle for the month of July. However,…

Raw cotton now taxable under reverse charge

Section 9(3) of CGST act provides that the specified goods and services shall be chargeable under reverse charge. Notification Central Tax (Rate) specifies the list of such goods. The Notification…

Amendments in exemptions as decided in GST council meeting

In the recent 23 GST council meeting, decisions were taken regarding substitution, insertion and omission of various exemptions. Notification in this regard has been issued by CBEC. Read the notification…

Amendments in GST rates made by GST council

In the recent 23 GST council meeting, changes were made in rates of various goods bringing down the burden on numberous goods from 28% to 18%. Notification in this regard…