Archives for January, 2018 - Page 2

25th GST council meeting

25th GST council meeting was chaired today by Union Finance Minister Shri Arun Jaitley in New Delhi wherein policy changes were recommended by GST council. The following policy changes were recommended…

25th GST Council Meeting Recommendations

25 GST Council Meeting was chaired by Union Finance Minister Shri Arun Jaitley today in New Delhi. Many recommendations were made by the council today. These recommendations shall come into effect…

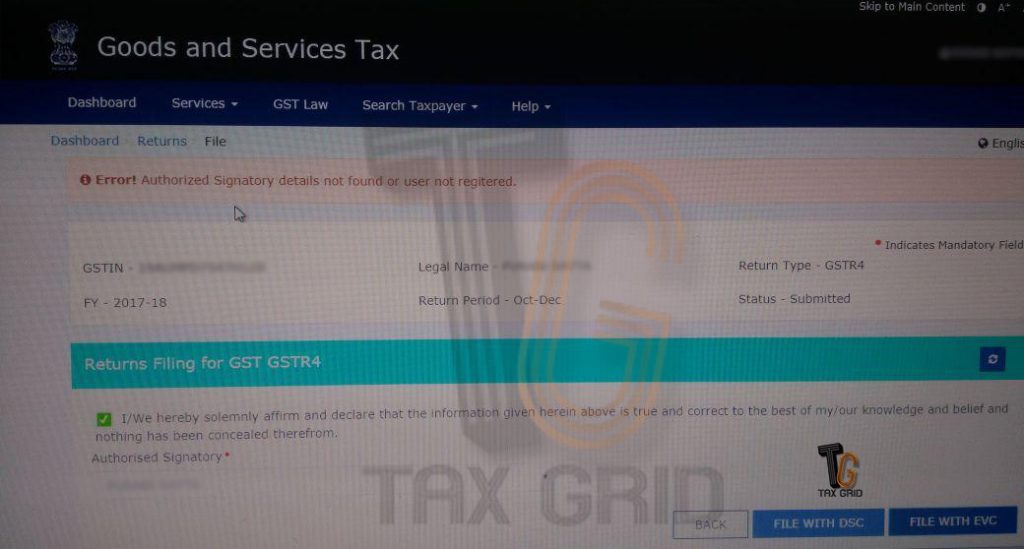

Authorized Signatory details not found

Many taxpayers are facing the error saying "Authorized Signatory details not found or user not regitered ". The error is being faced by those taxpayers who are filing the GSTR1 return…

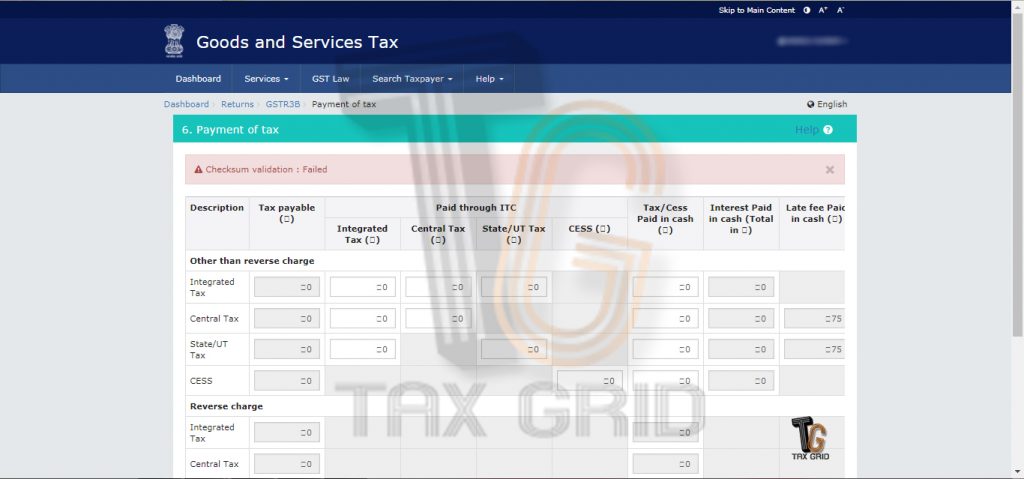

Error “Checksum validation : Failed”

Many taxpayers are facing the error issue. Error “Checksum Validation: Failed” is being shown up to the taxpayers on the payment if tax screen after OFFSET LIABILITY option is selected.…

Six months of Goods and Services Tax in India

Six months of Goods and Services Tax in India and Way Forward By Priyanshu Goyal The midnight of 1st July 2017 experienced the future changing historic tax reform in India…

ITC-01 enabled on GST portal for availing ITC in various cases

ITC 01 is now enabled on portal for availing Input Tax Credit in various situations like the one illustrated below: Registered persons whose exempt supply of goods and/or services become…

GST on College Hostel Mess Fees

Many Educational institutions have mess facility for students within the premises which is either run by the institution/ students themselves or is outsourced to a third person. Any supply of…

No extension of last date for filing GSTR1

Rumours are being spread on social media regarding the extension of the last date for filing of Form GSTR-1. Also, the fake document numbered as Notification - Central Tax is…

Clarifications regarding levy of GST on services like accommodation, betting

Clarifications regarding levy of GST on accommodation services, betting and gambling in casinos, horse racing, admission to cinema, homestays, printing, legal services etc. Representations were received from trade and industry…

When will errors rectified in GSTR3B will be reconciled?

The government notified the FORM GSTR-3B in order to collect taxes in the absence of FORM GSTR3. It was communicated by the government that the summarized data of inward and…