Archives for 2018 - Page 6

Provisional ID not activated

The period for migration from VAT/Service Tax and Central excise ended on 31st December 2017, being the period of six months from the appointment date. The migration was possible by…

Last date to file GSTR3B extended

Taxpayers have been facing issues in filing returns on GST common portal. Several errors are being faced by taxpayers since last week. Even today the portal was facing issues. The…

GST rate on works contract

GST Rate on Works Contract In 25 GST council meeting held on 18 January 2018, it has been recommended by GST Council to reduce GST rate on works contract services (WCS)…

State code list in GST

In GST list of state code is required for various purposed. State code list in GST can be found below: State TIN Number State Code Andaman and Nicobar Islands 35…

25th GST council meeting

25th GST council meeting was chaired today by Union Finance Minister Shri Arun Jaitley in New Delhi wherein policy changes were recommended by GST council. The following policy changes were recommended…

25th GST Council Meeting Recommendations

25 GST Council Meeting was chaired by Union Finance Minister Shri Arun Jaitley today in New Delhi. Many recommendations were made by the council today. These recommendations shall come into effect…

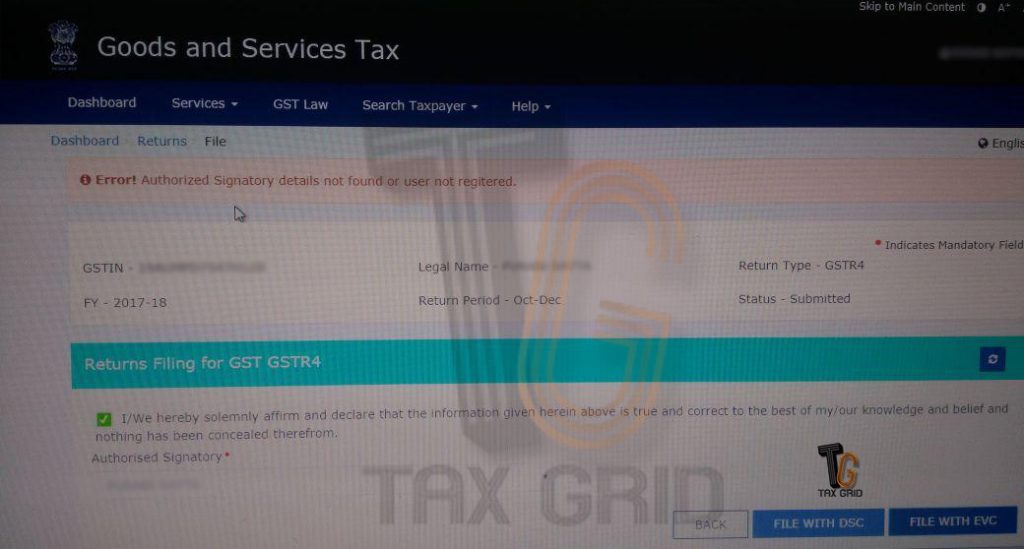

Authorized Signatory details not found

Many taxpayers are facing the error saying "Authorized Signatory details not found or user not regitered ". The error is being faced by those taxpayers who are filing the GSTR1 return…

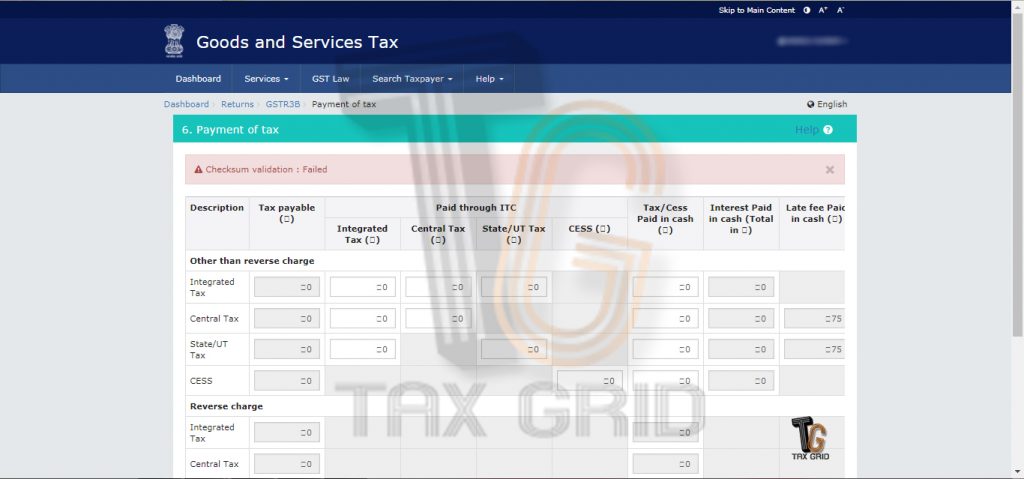

Error “Checksum validation : Failed”

Many taxpayers are facing the error issue. Error “Checksum Validation: Failed” is being shown up to the taxpayers on the payment if tax screen after OFFSET LIABILITY option is selected.…

Six months of Goods and Services Tax in India

Six months of Goods and Services Tax in India and Way Forward By Priyanshu Goyal The midnight of 1st July 2017 experienced the future changing historic tax reform in India…

ITC-01 enabled on GST portal for availing ITC in various cases

ITC 01 is now enabled on portal for availing Input Tax Credit in various situations like the one illustrated below: Registered persons whose exempt supply of goods and/or services become…