ITC under form GSTR-3B

It's time to file GSTR-3B soon and the taxpayers are getting confused as to how they can avail Input Tax Credit (ITC) in Return GSTR-3B. Another question because of which taxpayers are getting worried is that what will happen to their Transitional ITC, which if not allowed to be availed in GSTR-3B will result in the excess working capital outflow.

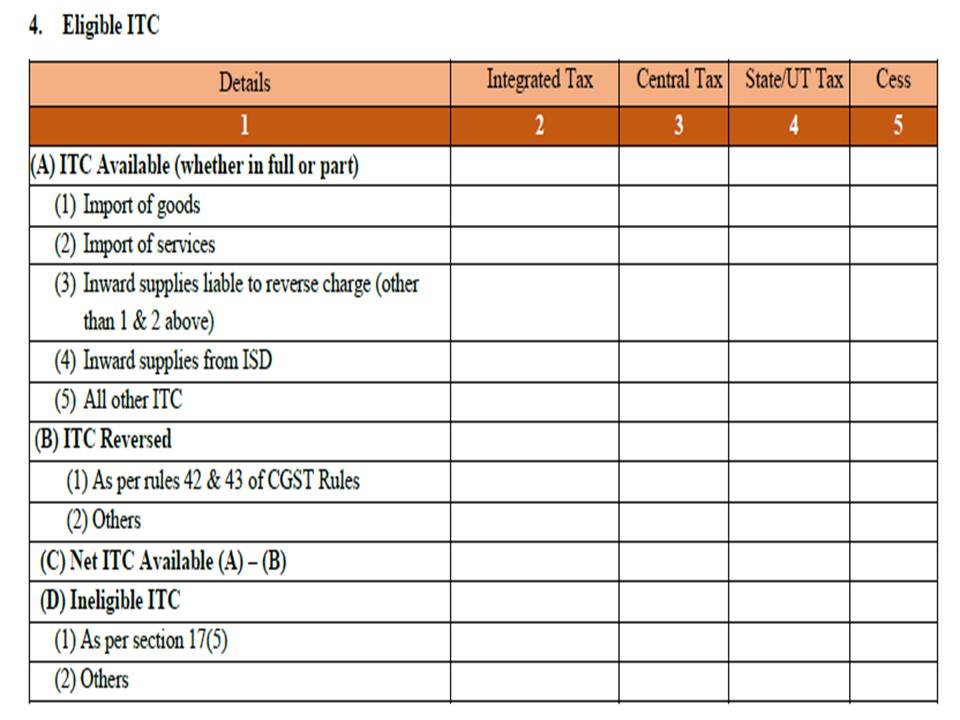

First, let's analyze the ITC column in form GSTR-3B.

In part (A) ITC Available (whether in full or part), details of the ITC available will be disclosed. Description of type of ITC that can be availed in each option is explained as follows:

(1) Import of goods - Goods which have been imported, IGST on them will be payable under the reverse charge and the credit of it will be available.

(2) Import of services- Services which have been imported, IGST on them will be payable under the reverse charge and the credit of it will be available.

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) - supplies received on which GST has to be paid in reverse charge other than in relation to imports are to be disclosed here.

(4) Inward supplies from ISD - ITC which shall be available from Input Service Distributor will be shown here.

(5) All other ITC - Other supplied procured in the relation of which ITC will be available will be disclosed here.

In part (B) ITC Reversed, details of ITC which has to be reversed is to be disclosed.

In part (C) Net ITC Available (A) – (B), the net amount of ITC which is available shall be calculated.

In part (D) Ineligible ITC, details of ITC which is not eligible to be taken has to be disclosed here. Like any supply received on which ITC is blocked in accordance with section 17(5) will be shown in subpart (1).

Calculation of the above amounts to be filled in relevant columns can be a difficult task for an individual taxpayer, as they may face problem in calculating the relevant amount to be punched in against each option. Also, the data being punched in GSTR-3B will auto-populate in part A of GSTR-3 whenever it is filed. For example- for the month of July, GSTR-3B has to be filed by 20th August and GSTR-3 has to be filed by 15th September. So when GSTR-3 will be filed for the month of July the part A of GSTR-3 will get auto-populated on the basis of data being filed in GSTR-3B. So it requires the taxpayers to hire proficient Tax Consultants who can undertake this task effectively.

As far as the question of transitional ITC is concerned, there is no option available for it in GSTR-3B. Then whether business concerns will have to bear the extra working capital burden or there will be some remedy from the government is the question which is yet unanswered, but experts hope that there will be a solution to this notified soon as the government is aware of the problem.

For Paid Assistance and getting your GSTR-3B filed without any errors contact TaxGrid at support@taxgrid.in.

Register for Free Demo of TaxGrid GST Application on https://taxgrid.in/software-demo/ and file the GST Returns easily

Dear Sir,

We are the merchant exporter exporters.

We purchase material and we export as it is.

while filing GSTR- 3B we have missed out to file one purchase invoice.

Please let us know how to file the Missed out purchase invoice.

We have exported that material.

Thanks & Regards,

karthik.

Dear Karthik,

If you have submitted the return, then you will not be able to file missed out the invoice in GSTR3b and any adjustment further can be done in GSTR-1 only.

sir i have paid rent to unregistered person and my liability was there on the reverse charge basis. Which i have shown in part 1 of outward supply. whether i need to disclose these in uinward supply liable for reverse charge in ITC section as i have deposited my liability for rcm

You need to show the same for availing the credit of any tax paid.

Sir,

How to avail ITC on imports of goods CGST & SGST for intrastate purchases?

That Option Is Greyed/Locked.

Please reply and resolve ASAP.

Thank you!

what if ive not diclosed the amount if ineligible itc in the previous returns of 3B

I, submitted by gstr 3B. But mistakely I filled my ITC in the colmn of reverse charge, towards All other ITC . I lost my ITC twice from my tax liability . how can i rectify the same.

Sir,

You can make the corrections in the next month return. You can accordingly adjust in next month return.

sir i have posted wrongly my itc in column of reverse charge instead of all other itc how to rectify this