Author Archives: taxgrid - Page 23

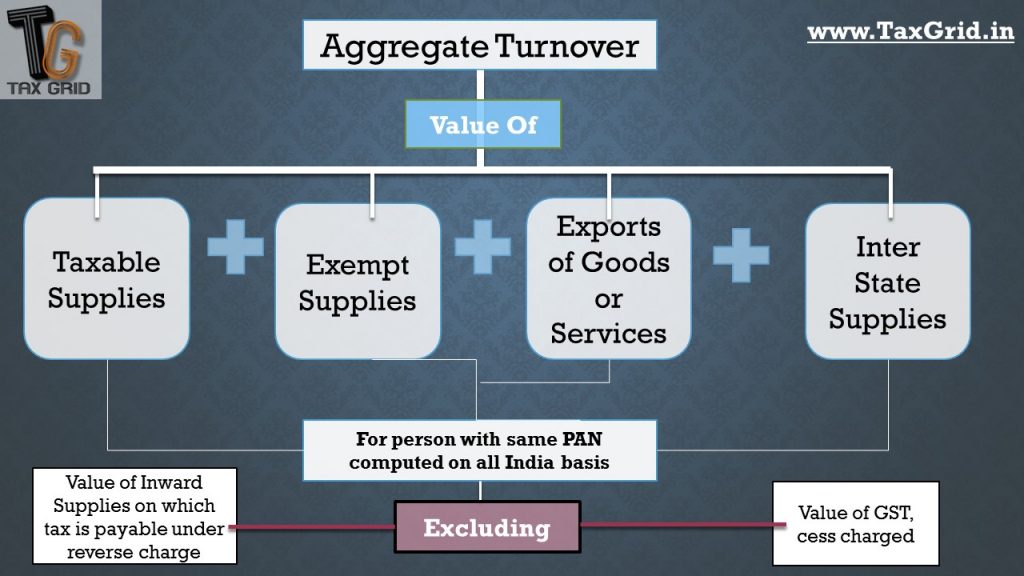

Aggregate turnover

Section 2(6) “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis),…

GSTN launching Offline Utility

GST is all set to roll out from 1 July and the corporate sector is trying to cope with new tax regime at its best. GSTN (Goods and Service Tax…

THE CHHATTISGARH GOODS AND SERVICES TAX

THE CHHATTISGARH GOODS AND SERVICES TAX Find out the THE CHHATTISGARH GOODS AND SERVICES TAX, Bill 2017. Act was passed on 28 April, copy of Act is not avaiable on…

THE RAJASTHAN GOODS AND SERVICES TAX ACT, 2017

THE RAJASTHAN GOODS AND SERVICES TAX ACT, 2017 Find out the THE RAJASTHAN GOODS AND SERVICES TAX ACT, 2017. Act was passed on 26 April, 2017. Read it online and…

THE BIHAR GOODS AND SERVICES TAX ACT, 2017

THE BIHAR GOODS AND SERVICES TAX ACT, 2017 Find out the THE BIHAR GOODS AND SERVICES TAX ACT, 2017. Act was passed on 24 April, 2017. Read it online and…

THE TELANGANA GOODS AND SERVICES TAX ACT, 2017

THE TELANGANA GOODS AND SERVICES TAX ACT, 2017 Find out the THE TELANGANA GOODS AND SERVICES TAX ACT, 2017. Act was passed on 9 April, 2017. Read it online and…

Is your ERP GST Compatible??

The most important question before welcoming GST ( Goods and Service Tax) which is yet to be answered by most of the companies in every industry is "Is your ERP…

GSTN last call to Migrate

Migration to upcoming GST Act has started once again from 1st June. This is the last chance to get registered under GST Act. Upcoming Goods and Service Tax Act brings…

E-way Bill

E-way Bill Find the short note on E-way Bill contributed by TaxGrid Member. Contributed by Sahil Your comments and feedback are welcome. Use the feedback form in the sidebar or…

GST for Janta

GST FOR JANTA Find the short E-book complied at TaxGrid. Get to know the basics of GST with our E-book series GST For JANTA. Topics Covered under This part Taxablity…