Archives for GST-Beginners - Page 3

Read about Anti-Profiteering measures

Why Anti-Profiteering Measures? 17th July 2000 was the day when the seeds were sown for the newly established indirect taxation reform GST (Goods and Services Tax) and finally after 17 years…

ANALYSIS OF PROPOSED AMENDMENTS IN COMPOSITION SCHEME IN GST COUNCIL MEETING

By CA Parampreet Khurana The GST Council in its the 22nd meeting held on 6 October 2017 has brought in necessary changes in its composition scheme. The Government has extended…

What was the confusion regarding last date of filing FORM GST TRAN-1?

Why taxpayers got confused as to what is the last date of filing FORM GST TRAN-1 owing to the consecutive press release, notification, and order issued by CBEC? Many taxpayers…

TDS Provision applicable from 18th September 2017

18th September 2017 is the day from which TDS provisions shall come into force by Notification No. 33/2017 – Central Tax and Section 51 of the Central Goods and Service…

GSTR3B continues till December

In 21st GST council meeting, it was decided that GSTR-3B shall be continued until the month of December. Notification No. 35/2017 – Central Tax released by CBEC confirmed the decision.…

Can taxpayer pay tax by 28th august now

Can taxpayer pay tax by 28th August now? New notifications issued by CBEC enabling taxpayers to claim the transitional ITC, has created a lot of confusion among the assessee. Although,…

Sectoral FAQs: Gems & Jewellery

CBEC has released a booklet relevant to Gems & Jewellery industry, which contains various Frequently Asked Questions (FAQs). Read the booklet issued below: Sectoral FAQs: Gems & Jewellery Letter to…

Central Goods and Services Tax (Fifth Amendment) Rules, 2017 notified

CBEC has notified Central Goods and Services Tax (Fifth Amendment) Rules, 2017 via Notification No. 22/2017 – Central Tax. You can read the notified amendment rules below and the TaxGrid…

GST For Janta – GSTR3B Guide

Date of filing GSTR-3B is near and there is a lot of confusion among taxpayers as to how the return filing mechanism will work. GSTR3B is the provisional return form…

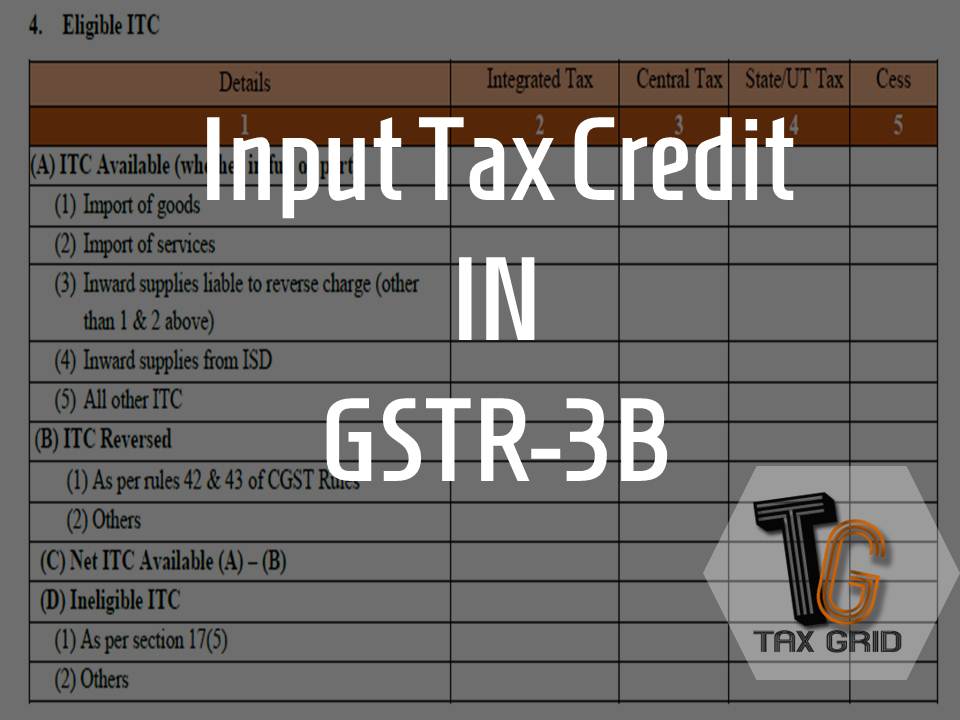

ITC under form GSTR-3B

It's time to file GSTR-3B soon and the taxpayers are getting confused as to how they can avail Input Tax Credit (ITC) in Return GSTR-3B. Another question because of which…