Archives for GST portal - Page 2

E-way Bill has been deferred owing to technical glitches

It has been recently communicated by the government that the application of E-way bill has been deferred owing to technical glitches in the system. The public was facing problem in…

E-way bill portal notified

E-way bill portal has been notified vide Notification No. 9/2018 – Central Tax. The notification has been issued in the supersession of Notification No. 4/2017 – Central Tax. Purpose of GST common portal…

Late Fee for GSTR1 reduced

Amount of late fee for GSTR1 which is payable by any registered person for failure to furnish the details of outward supplies for any month/quarter in FORM GSTR-1 by the…

Provisional ID not activated

The period for migration from VAT/Service Tax and Central excise ended on 31st December 2017, being the period of six months from the appointment date. The migration was possible by…

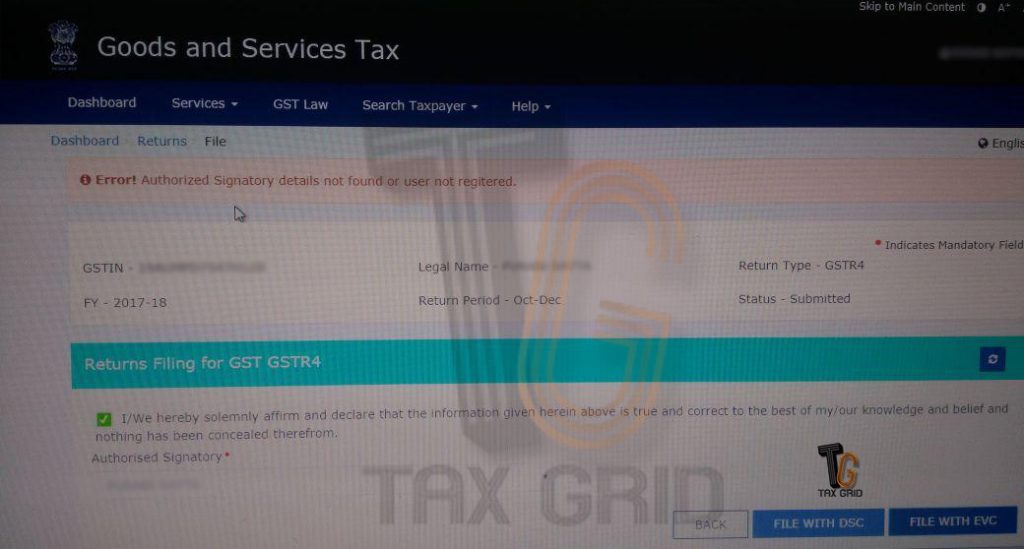

Authorized Signatory details not found

Many taxpayers are facing the error saying "Authorized Signatory details not found or user not regitered ". The error is being faced by those taxpayers who are filing the GSTR1 return…

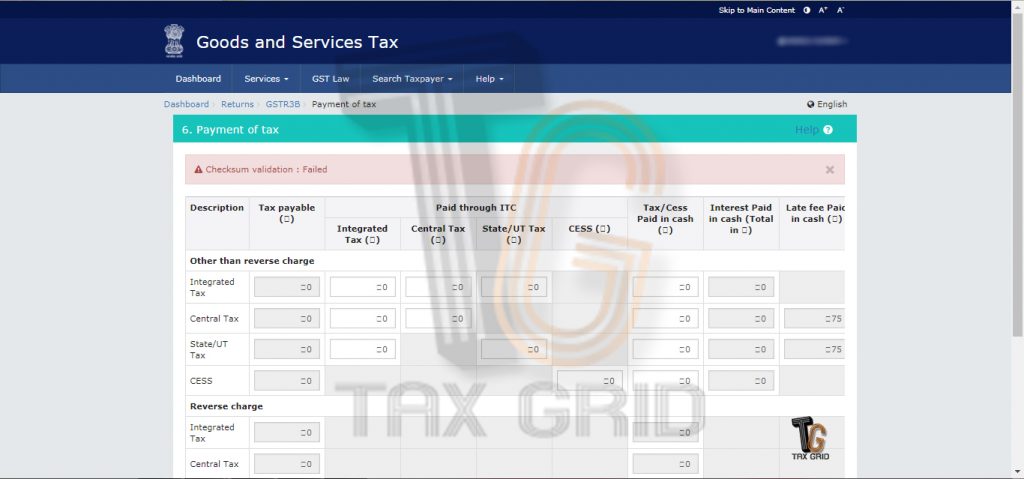

Error “Checksum validation : Failed”

Many taxpayers are facing the error issue. Error “Checksum Validation: Failed” is being shown up to the taxpayers on the payment if tax screen after OFFSET LIABILITY option is selected.…

ITC-01 enabled on GST portal for availing ITC in various cases

ITC 01 is now enabled on portal for availing Input Tax Credit in various situations like the one illustrated below: Registered persons whose exempt supply of goods and/or services become…

When will errors rectified in GSTR3B will be reconciled?

The government notified the FORM GSTR-3B in order to collect taxes in the absence of FORM GSTR3. It was communicated by the government that the summarized data of inward and…

Date for Filing GSTR1 for taxpayers with turnover more than 1.5 crore extended

The due date for filing FORM GSTR1 by taxpayers with turnover more than Rs crores has been extended vide Notification No. 72/2017 – Central Tax. Now the GSTR1 for the period…

Advance ruling- Steps to be followed to seek an hearing

There are many taxpayers who are of whish to obtain Advance Ruling before proceeding with their business in the tax regime or maybe even registered taxpayers might want to seek…