Archives for GST - Page 10

Sectoral booklet for Mining released by CBEC

CBEC has released a booklet relevant to industries engaged in Mining, which contains various Frequently Asked Questions (FAQs). Read the booklet issued below: Decisions taken on Services at 20th GST…

FAQs in relation to GSTR-3B return filing

It is more than month now that GST has been implemented and people have been struggling with the new law. Also the confusion is getting worse as the date of return…

Features of GST

Features of GST as enumerated in Press release by Ministry of Finance PIB Goods and Services Tax (GST) is intended to bring transparency and accountability in business transactions along with…

Sectoral booklet for Exports released by CBEC

CBEC has released a booklet relevant to industries engaged in Exports, which contains various Frequently Asked Questions (FAQs). Read the booklet issued below: Organized traders and unorganized sellers in Textile…

GST and Exports

GST and Exports Find the latest document released by CBEC in relation to exporters in GST. Read Online. Use the feedback form in the sidebar or contact us page to…

GSTN Offline utility Launched

GST implemented from 1st July 2017 attracting all new set of compliance formalities for taxpayers. With the rise of the new tax regime, many software companies found the golden opportunity…

GST Impact on Manpower Service Industry

GST Impact on Manpower Service Industry Find the short PPT complied at TaxGrid. Get to know the Impact of GST on Manpower service providers under GST. This presentation was designed…

Form GSTR3B

Council in its meeting on 18th June came out with some relaxation for taxpayers in the form of reduced compliance burden for first two months of the new tax regime.…

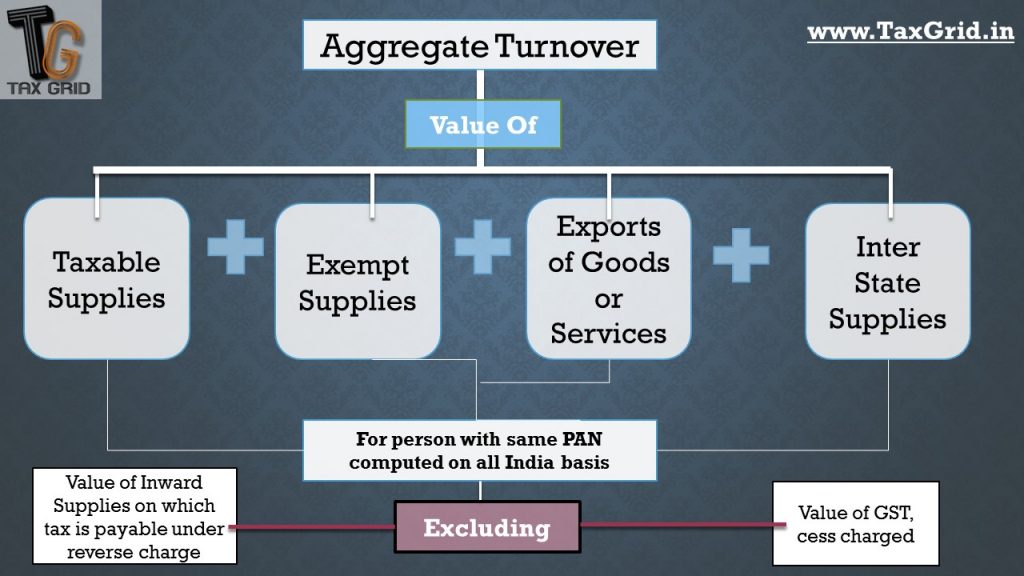

Aggregate turnover

Section 2(6) “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis),…

GSTN launching Offline Utility

GST is all set to roll out from 1 July and the corporate sector is trying to cope with new tax regime at its best. GSTN (Goods and Service Tax…