Tag archives for gstr 3b

GSTR3B continues till December

In 21st GST council meeting, it was decided that GSTR-3B shall be continued until the month of December. Notification No. 35/2017 – Central Tax released by CBEC confirmed the decision.…

Reconciliation of information in GSTR-1 and GSTR-2 with GSTR-3B

Initially, for two months of July and August, the government extended the date of filing GSTR-1 and GSTR-2 and rolled out GSTR-3B. It was made clear that information being furnished…

Notification regarding waiving of late fee on GSTR-3B

Earlier in the press release, it was communicated that Late fee won't be levied on the returns for the interim period, to give the sense of comfort to taxpayers, but…

What if any invoice gets missed in GSTR-3B?

What if any invoice gets missed in GSTR-3B? Currently, One of the hot questions in relation to GSTR-3B is that if any invoice data gets missed while filing return, then…

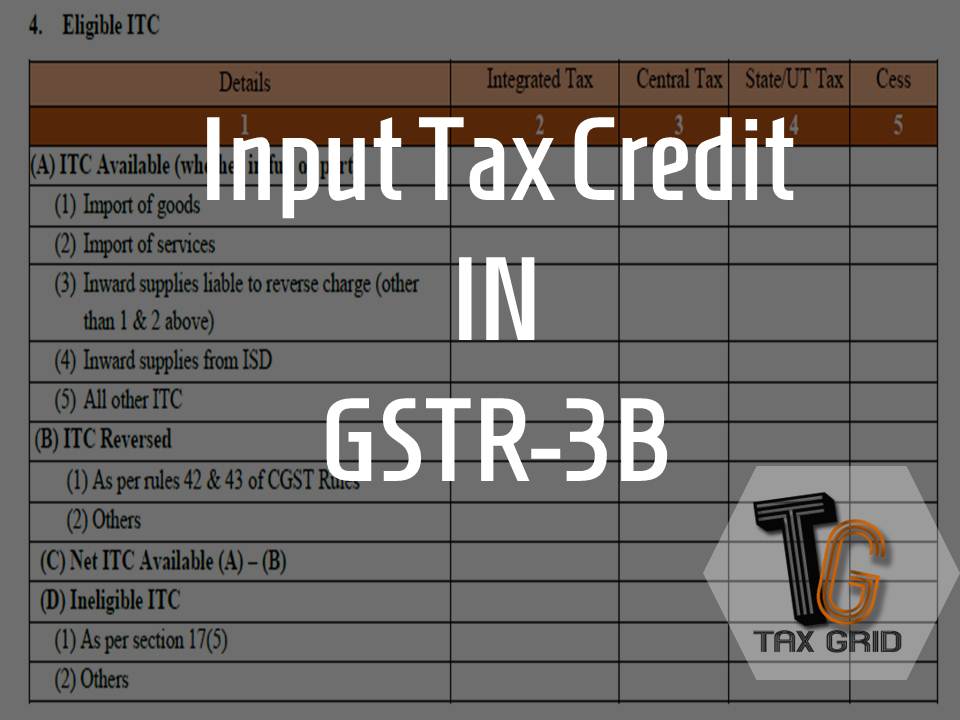

ITC under form GSTR-3B

It's time to file GSTR-3B soon and the taxpayers are getting confused as to how they can avail Input Tax Credit (ITC) in Return GSTR-3B. Another question because of which…

FAQs in relation to GSTR-3B return filing

It is more than month now that GST has been implemented and people have been struggling with the new law. Also the confusion is getting worse as the date of return…

Form GSTR3B

Council in its meeting on 18th June came out with some relaxation for taxpayers in the form of reduced compliance burden for first two months of the new tax regime.…