Archives for January, 2017

Utilization of Credit- obsolete

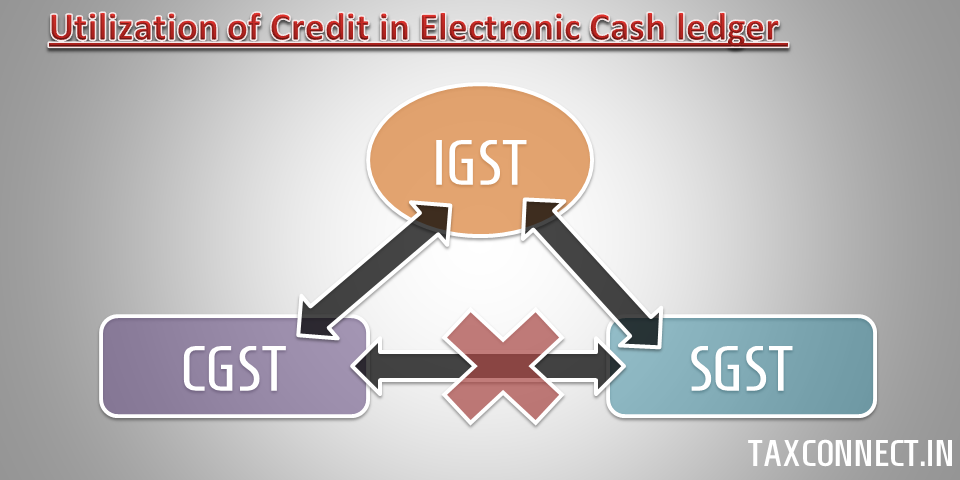

Section 44(5)(a) can be interpreted clearly with the help of diagrammatic representation above. Sec 44(5) - (a) The amount of input tax credit on account of IGST available in the electroniccredit ledger…

The Gazette of India after GST bill received President assent

The Constitution (One Hundred and Twenty-Second Amendment) Bill, 2014 after ratification by the States, received assent from President Pranab Mukherjee on 8 September 2016 and was notified in The Gazette…

Notice of amendment on The Constitution (122nd Amendment) Bill, 2014,

Various amendments were moved by Finance Minister Arun Jaitely on 1 August, 2016. Step by Step Guide for GST Enrolment for existing Central Excise / Service Tax Assessees The Gazette…

First Discussion Paper On Goods and Services Tax In India , 2009

The Discussion Paper is divided into four parts. Since GST would be further improvement over the VAT, part 1 begins with a brief reference to the process of introduction of…

Report of the Task Force on implementation of the FRBM ( Fiscal Responsibility and Budget Management) Act, 2013

Step by Step Guide for GST Enrolment for existing Central Excise / Service Tax Assessees The Gazette of India after GST bill received President assent Notice of amendment on The…

GST Timeline

Find the complete timeline about how GST was introduced and the actions which made the way possible towards its implementation.

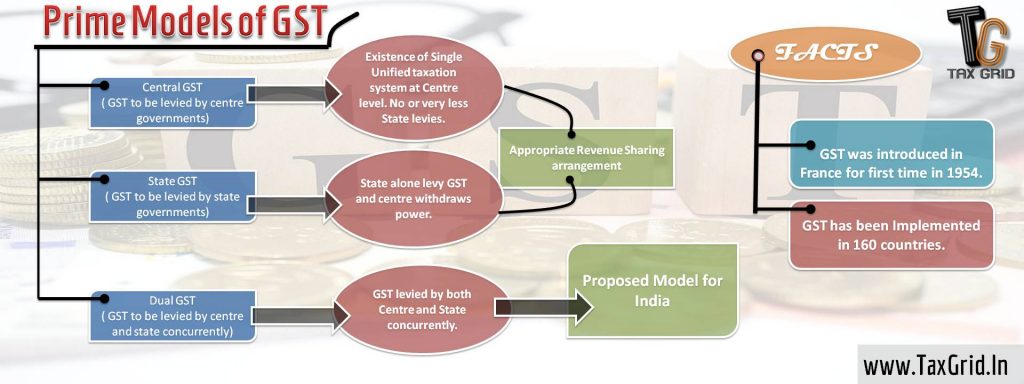

Prime Models of GST

Three Models of GST can be: Central GST ( CGST) State GST (SGST) Dual GST The overview of these can be taken through the above image. For detailed explanation regarding…

Revised Draft Model GST Law

101st Constitution Amendment Act, 2016 (2016) Letter to government by Sales tax bar association FAQs on GST THE CONSTITUTION (ONE HUNDRED AND TWENTY-SECOND AMENDMENT) BILL, 2014

101st Constitution Amendment Act, 2016 (2016)

Letter to government by Sales tax bar association FAQs on GST THE CONSTITUTION (ONE HUNDRED AND TWENTY-SECOND AMENDMENT) BILL, 2014