Utilization of Credit- obsolete

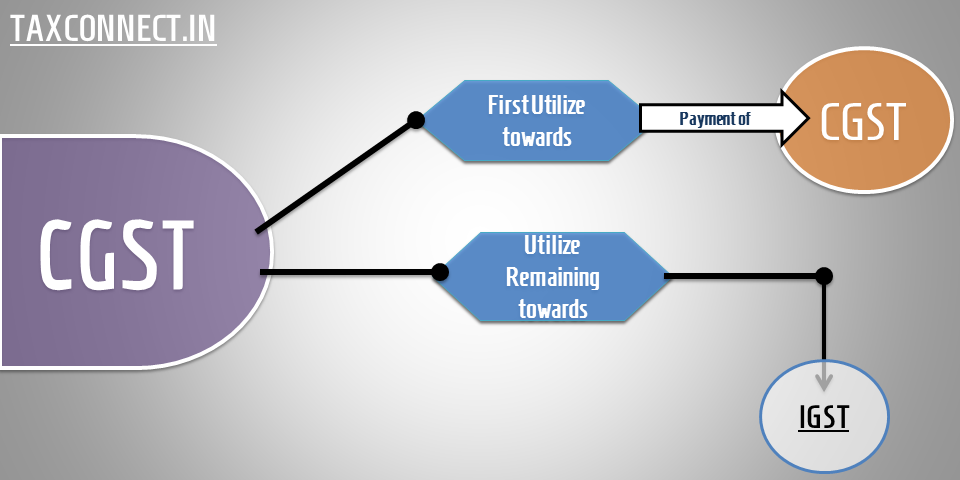

Sec 44(5)(a)

Section 44(5)(a) can be interpreted clearly with the help of diagrammatic representation above.

Sec 44(5) -

(a) The amount of input tax credit on account of IGST available in the electronic

credit ledger shall first be utilized towards payment of IGST and the amount

remaining, if any, may be utilized towards the payment of CGST and SGST, in

that order.

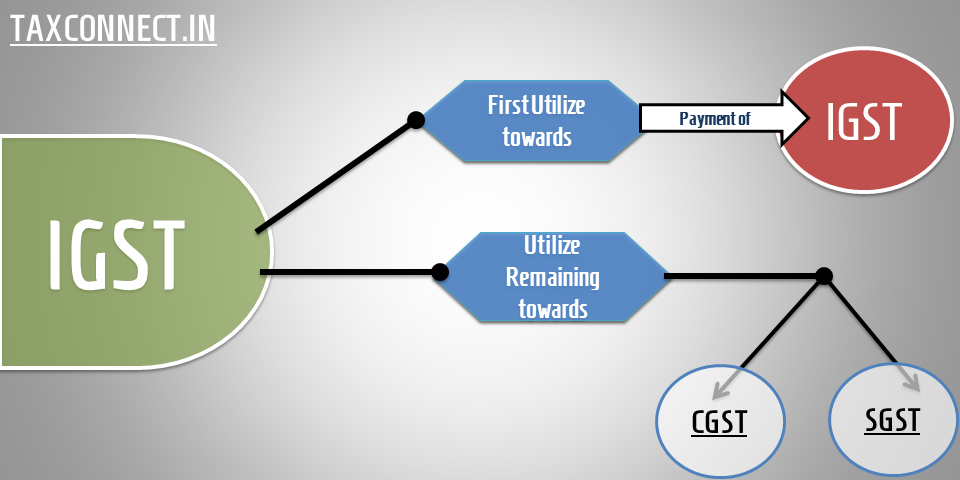

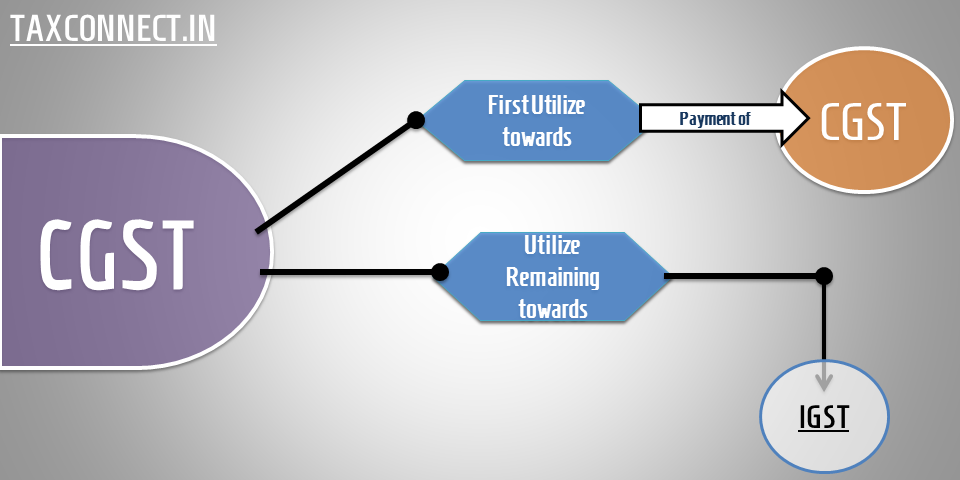

Sec 44(5) - CGST Act

Section 44(5) can be interpreted clearly with the help of diagrammatic representation above.

Sec 44(5) -

(b) The amount of input tax credit on account of CGST available in the electronic

credit ledger shall first be utilized towards payment of CGST and the amount

remaining, if any, may be utilized towards the payment of IGST.

(c) The input tax credit on account of CGST shall not be utilized towards payment

of SGST.

{CGST Act}

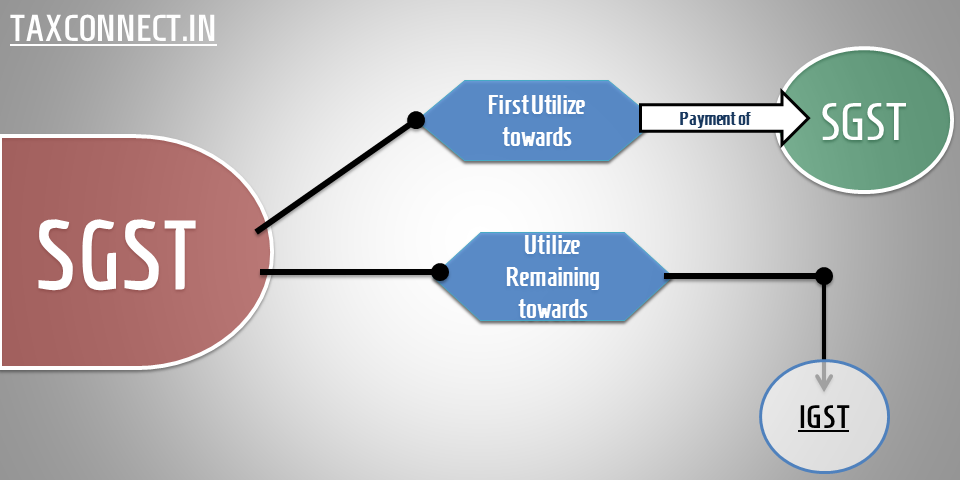

Sec 44(5) - SGST Act

Sec 44(5) can be interpreted clearly with the help of above diagram.

Sec 44(5) SGST Act reads as:

(b) The amount of input tax credit on account of SGST available in the electronic

credit ledger shall first be utilized towards payment of SGST and the amount

remaining, if any, may be utilized towards the payment of IGST.

(c) The input tax credit on account of SGST shall not be utilized towards payment

of CGST.

{SGST Act}

Leave a Reply