Aggregate turnover

taxgrid

June 22, 2017

Aggregate turnover2017-06-22T01:34:41+05:30

GST-Beginners, GST-diagram presentations

No Comment

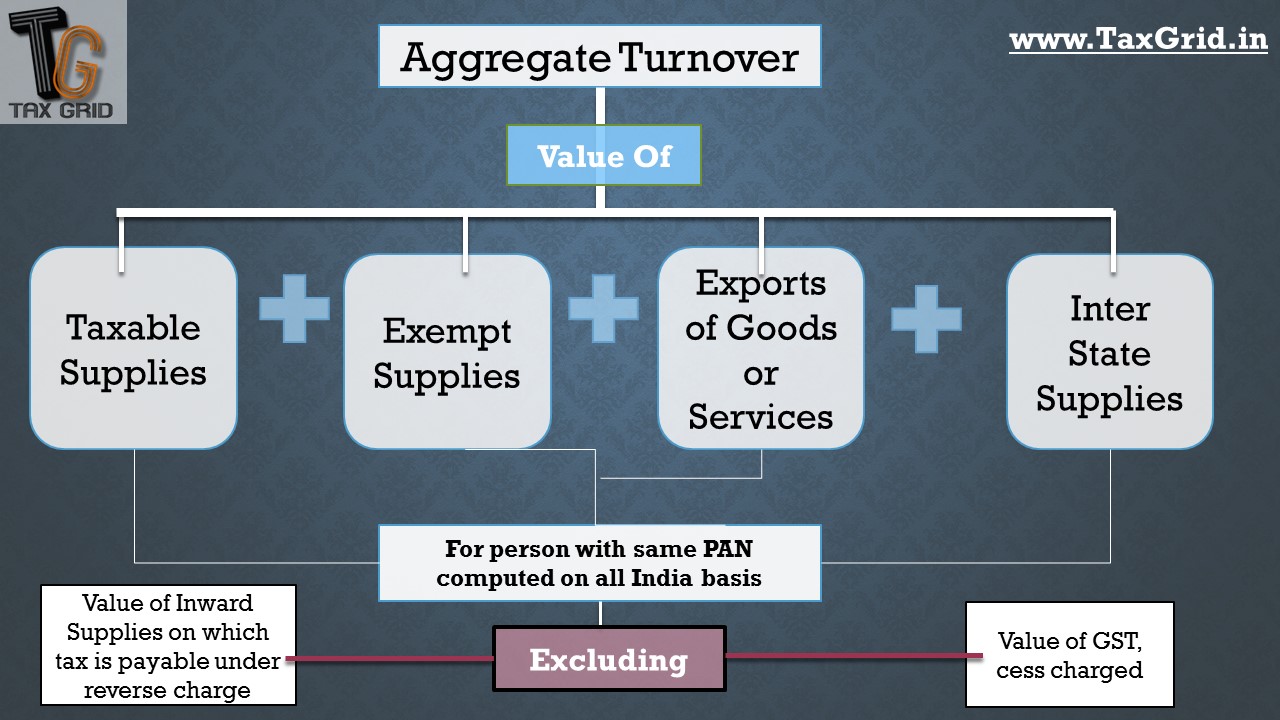

Section 2(6)

“aggregate turnover” means the aggregate value of all taxable supplies

(excluding the value of inward supplies on which tax is payable by a person on reverse

charge basis), exempt supplies, exports of goods or services or both and inter-State

supplies of persons having the same Permanent Account Number, to be computed on all

India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess;

Leave a Reply