Why is late fee being shown up in GSTR3b for september

Taxpayers are facing the new confusion by finding the amount of Late fee in the return GSR3b for the month of September even when the last date to file the return has still not elapsed. Many people have misunderstood this to be the error in GSTN portal, but the government has got clarification for this.

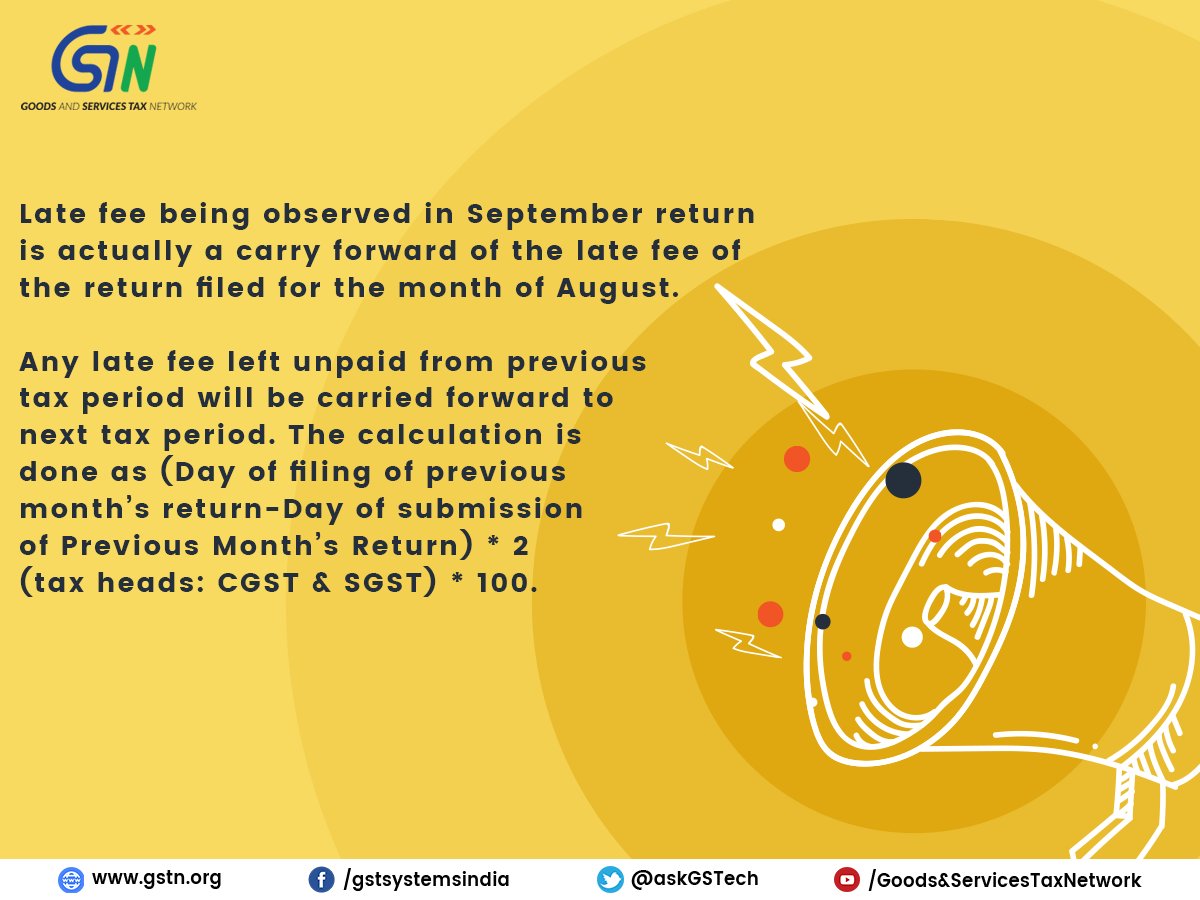

Answer: The Late fee which is being observed in your September's GSTR3b is actually the late fee for the month of August. The Late fee amount for the current month is calculated for the time till you have delayed the submission. But it might happen that you File the return even days after Submitting the return. As in GSTN portal, all the tables are blocked for editing once submitted, the late fee amount which shall be levied for the time from date of submitting till the date of filing is not calculated and shown and this amount shall be observed in the next month's return.

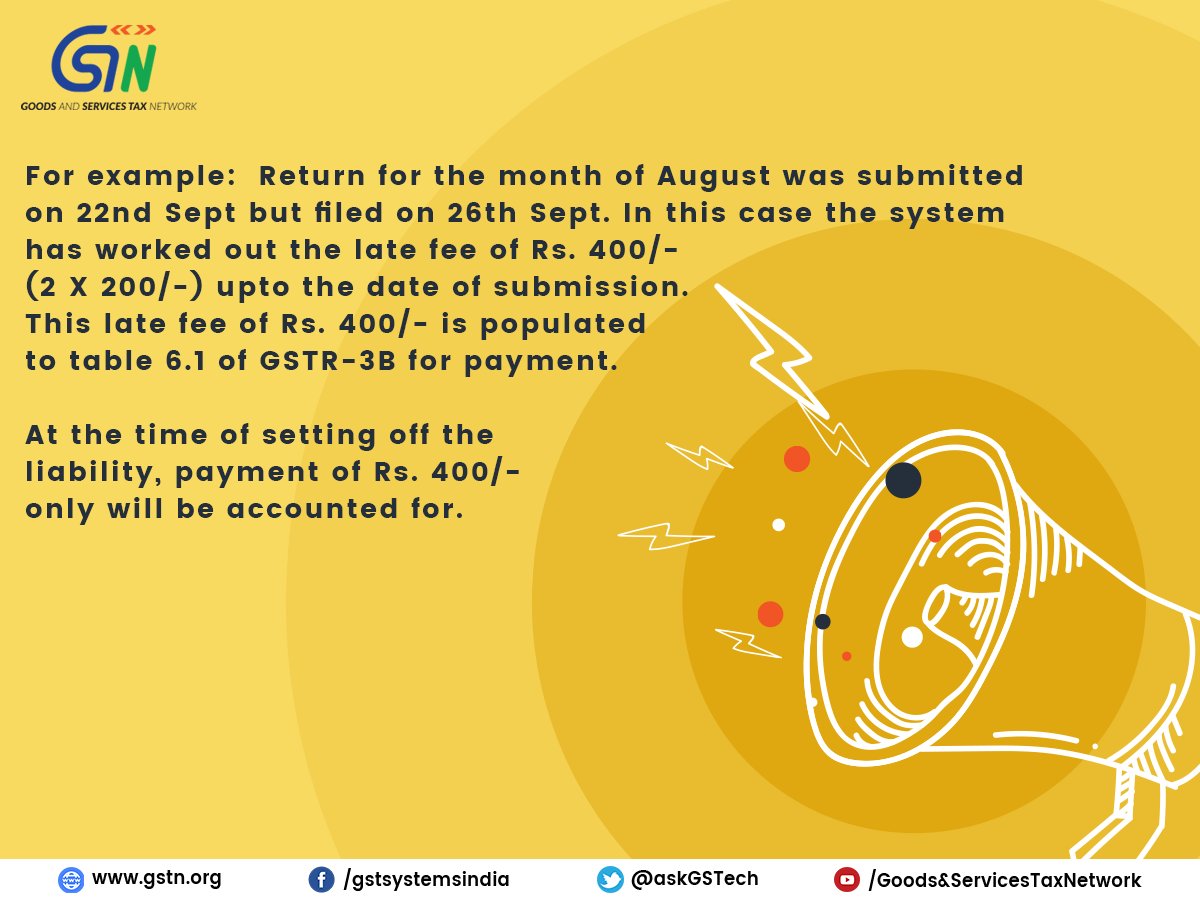

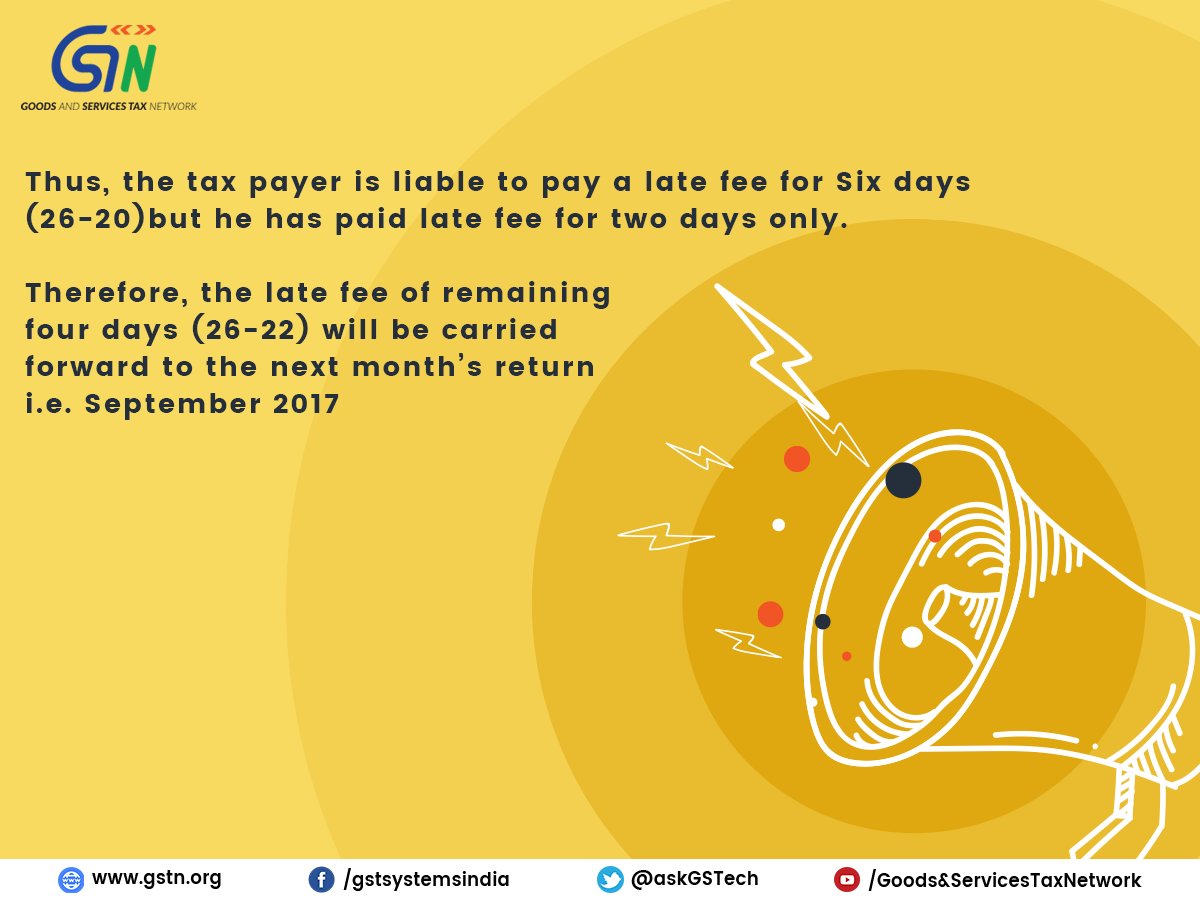

Say, for example, The last date for filing the GSTR3b for the month of August was 20 September and you submitted the return on 22 September but filed it on 26 September. The late fee which was calculated in August's GSTR3B would have been Rs 200 x 2 days (from 21 September to 22 September) = Rs 400. As the return was submitted on 22 September, further calculations and editing were blocked. Now, as you filed the return on 26 September the late fee penalty should have been Rs 200 x 6 days (from 21 September to 26 September) = Rs 1200. Since you paid only Rs 400 in September, the differential amount of Rs 800 shall be payable in next month's return i.e. in GSTR3b for the month of September (which is to be filed in October).

You can refer the images below for further more clarity:

Leave a Reply