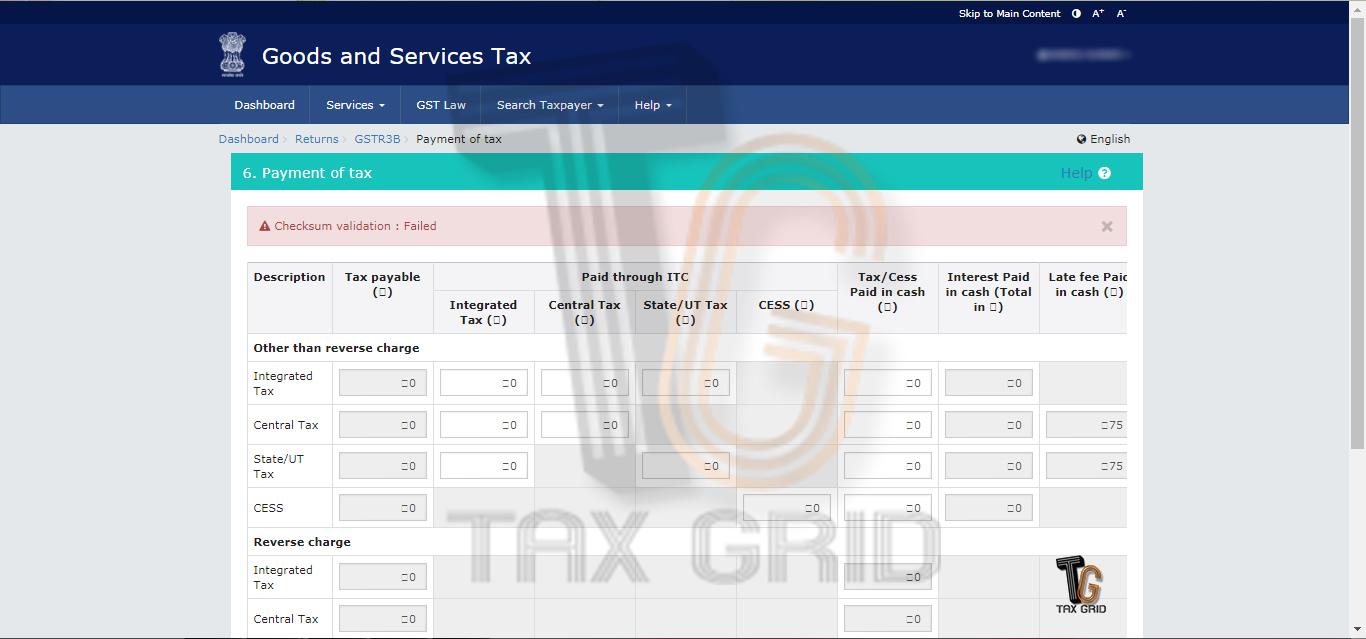

Error “Checksum validation : Failed”

Many taxpayers are facing the error issue. Error “Checksum Validation: Failed” is being shown up to the taxpayers on the payment if tax screen after OFFSET LIABILITY option is selected. There is as such no proven remedy for the error.

The one reason for the error can be the server being too busy at any particular time, but the same error is being faced by some users since many days. If the error is being faced, one can try clearing the cache of the browser, by pressing CTRL + SHIFT + DELETE or can try to reload over cache by pressing CTRL + SHIFT + R. The other available option is to try filing the return using any other browser.

The above-mentioned methods worked for few but were not able to redress the problems of many. If the return is not getting filed, then last resort is to turn up to GSTN helpdesk, by sending the mail with error screenshot.

If you are able to find any other solution, do mention in the comments for the benefit of the community. At TaxGrid we have always tried to help the community by reply to various GST queries for free, the database of which is being maintained for benefit of all at TaxGrid forums. So do check the forums to remain updated with all latest issues and contribute the part of your knowledge for the benefit of all using TaxGrid platform. Also, do register yourself to join the evolving community of professionals, traders, dealers and other stakeholders of Indian Taxation Economy and connect with them using TaxGrid social networking features. Let’s Grow together. Click here to register

I m facing the similar problem from last 3 days.

“Check sum Validation failed”.

The software is not user friendly.

its NATIONAL WASTE OF TIME.

finding ourselves HELPLESS.

sir we have problem in offset after payment when we are submitted offset the show the checksum validation error

Your suggestion of last resort to contact helpdesk is of no use. I have tried sending many messages to the helpdesk mail address, but all of them have bounced with “Mailbox Full” error. They don’t even receive your mails, let alone answer you!! But at the same time, they are very prompt to charge you penalties and interests. Hopeless situation.

If GSTN is unable to provide efficient software even after six month of launch, it shall be penalised for every default and further GSTN must pay the users for every such default because the user is wasting time in this software.

Agree if they are not able to solve problem immediately they should post it on website itself

The error (Checksum validation:Failed)is expected to be resolved today (16.01.2018) night. So, try to offset liability (GSTR 3B) / utilize cash (GSTR 4) tomorrow (17.01.2018).

Thank u sir..for giving me such confidence..

Gst help desk is not able to give such confidence

And they r saying we donot know how much time takes place to resolve this error…

thanks for your reply…..

the error is also show today morning 17-1-2018 in gstr4

sir this error is still there on website while offset liability

this error continues even now at 15.30 hours

I am facing the same error….the last date is 20 Jan 18 for the GST-3B FOR Dec 17….hope I do not have to pay a penalty….

I hope error will get removed by tonight ie. 16.01.2018.

However, as due date is approaching, make online complaint through USER SERVICES=>Grievances/Complaints after login.

i am from West Bengal facing the same problem ” Checksum Validation : Failed”

i am trying to file gstr3b for last may day but everyday i get this error “Checksum validation : Failed”, send email also but no reply, on phone no one pickup the call. now where to go GOD KNOWS. after 20th there will be penalty charged to us because of govt

there has to be some quick support for such complected errors, everything is under air and trying on everyday

there is nothing like support kind of things, to get one email reply, gst people take more than a week and we are dreaming for DIGITAL INDIA

I am facing the error when i press offset liability, Error checksum validation reflects. I tried for many times. Secondly the new questionare is not complete there isno place for Interstate sale to b2b those whoare not composite dealers but have regular GST Number. Lot oftime waste in filing returns. Toll free numbers and GST helpline is useless.

Regards

Paritosh Gulati

Making laws and rules is not important,

But smooth implementation is important.

Tax payer should also pay taxes and also penalised for the fault of others/system is not correct.

I am also facing the same error. from last three days and also mailed to GSTN but not replied yet . GSTN is very poor in this regard .

totally hopeless software. I do not know why government is not taking any action against software maker. Every time only business has to suffer. The all panely because of software should be paid by the software provider every time erro checksum validation fail comes.

totally hopeless site. I do not know why government is not taking any action against site maker. Every time only business has to suffer.

same problem occurring for us…..

Checksum validation : Failed error has come when I want to offset liability.

I filled GSTR4 Successfully. Not Error Show today so hope for all work fine.

same problem todaye 17/01/2018 @ Offset liability …… we can not file GSTR 1 for Dec 17

its not GSTR 1 actually it is GSTR 3B

The deadline for paying the tax without being penalised is 20th of this month. Do it or face late fee charges for no fault of the taxpayer. Good governance.

The problem still not resolved. I am facing the same problem in all gstr 4 filing.

THE SAME ERROR IS ONCE AGAIN APPEARING.

Pl. delete all temp files and try with Internet Explorer Browser, It worked for me…

Try to reset GSTR3B and key in all whole nos without decimals. I had the same problem and removing decimal places helped in filing GSTR3B successfully. Feel the system is throwing the error due to decimals.

sir payment not pay ,ERROR FORM VCPIN VALIDATION FAILED DUE TO :MASSAGE TAMPERED