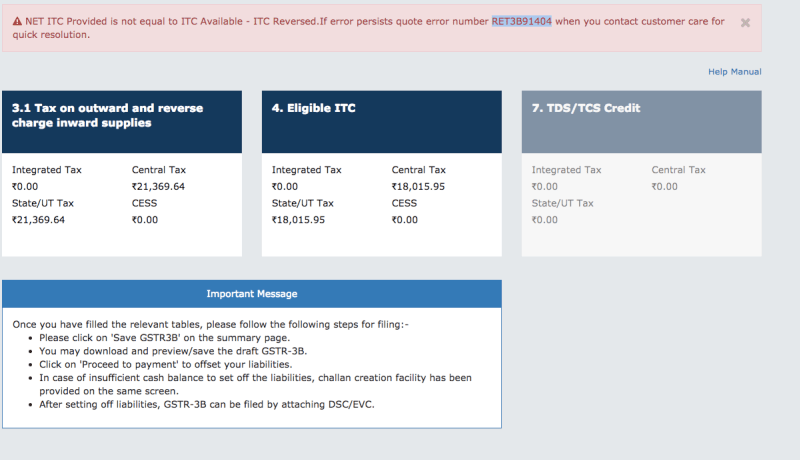

NET ITC Provided is not equal to ITC Available RET3B91404

NET ITC Provided is not equal to ITC Available - ITC Reversed. If error persists quote Error Number RET3B91404

GSTN has now simplified the GSTR3B filing process wherein the submit requirement to freeze details have been removed. Also, a pre-filled challan is now getting automatically generated by the system and also system suggested ITC can be found already filled. With these new automations, taxpayers have been facing the error which reads as "NET ITC Provided is not equal to ITC Available - ITC Reversed. If error persists quote Error Number RET3B91404 when you contact customer care for quick resolution".

This error gets generated due to the system error and is not because of any wrong input on the users part. It basically means that the ITC which has been provided in the return form to be claimed by the taxpayer is not equal to the ITC available in the system for claiming. This happens because of the time delay between the feeding of data and processing of data in the GSTN system. The ITC claimed by taxpayer takes some time to be processed and thus the user is suggested to once confirm in his ledger that whether the amount if input claimed is showing up or not. After saving the return, the taxpayer should wait and confirm the entry of ITC in his ledger before proceeding.

Although, no proved solution has come up to avoid this error or resolves it after occurring. If the above-mentioned method or some other way works for you mention it in comments.

if you fill rounded up amount in 3B.. and save draft , it have accept that.