Error RT-SCVU101

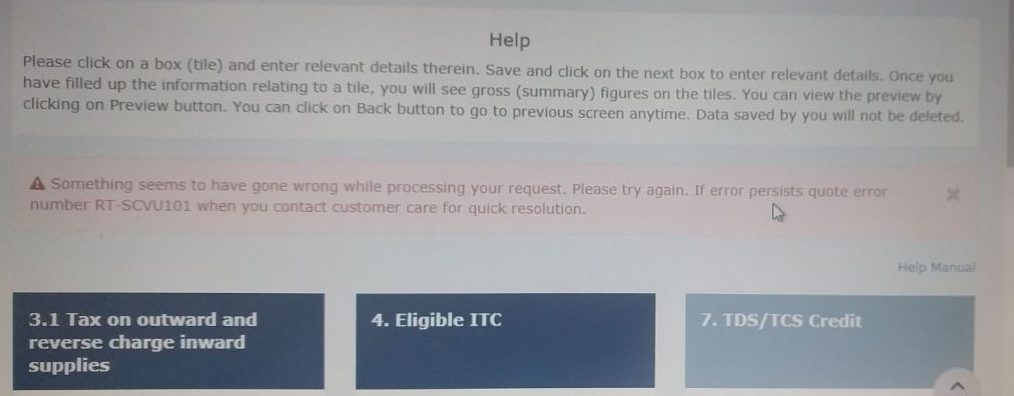

Taxpayers have been facing Error RT-SCVU101 while saving the data in FORM GSTR3B. Error reads out

Something seems to have gone wrong while processing your request. Please try again. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.

Reasons due to which this error number RT-SCVU101 arises

One possible reason for this error is that any amount in table 4 has been furnished in decimal. If data not furnished manually and imported through JSON with the help of any software or GSTN excel utility, then there can be chances that decimals are present in the values. So, removing decimal can be one solution for Error.

This error also arises when the net ITC in table 4 of GSTR3B- Eligible ITC is in negative due to the amount of ITC reversal being greater than ITC available. Making the amount of reversal equal to ITC available can solve the problem but then it may lead to non-compliance as the amount if ITC reversed is not being disclosed on the portal. So, if the amount involved is less and insignificant, taxpayers may proceed to file the return at their own risk.

Any official solution from GSTN is still awaited. Please feel free to comment any solution you have come across. Subscribe TaxGrid newsletter to get the latest updates in the inbox at https://taxgrid.in/newsletter

Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.

Plzzzz solve this problem immediately…

I have a problem in uploading GSTR 3B..

Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.

Plzzzz solve this problem immediately…

I have a problem in uploading GSTR 3B..

Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.

This is not a persistent problem in the current scenario. Try within a day or two. Shall get resolved.

i tried 4 to five time but this is showing sme error “Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.”

what shoud i do. i am entering data from tally

MY PROBLEM IS SAME.

Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.

SO YOU TELL ME HOW CAN RESOLVE THIS PROBLEM.

i m also facing the same issue

please reply how to correct it i m uploading from busy

have a problem in uploading GSTR 3B..

Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.

I have a problem in uploading GSTR 3B..

Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.

i have a same problem sir, how to solve this problem?? give me a solution

i tried 4 to five time but this is showing same Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution while

i also face the same problem

i also called customer care but they cant help me to solve it

plz Suggest me the accurate solution except customer care.