Author Archives: taxgrid - Page 19

GST Payment Process

Under GST law, the tax has to be paid by generating a challan which will be also saved on the portal. This challan creation process is although simple but some taxpayers…

Cabinet approves Scheme of Budgetary Support under GST Regime

Ministry of Commerce & Industry and Cabinet Committee on Economic Affairs (CCEA) jointly made the following press release: Cabinet approves Scheme of Budgetary Support under GST Regime to the eligible units…

What is the difference between Nil Rated, Zero Rated and Exempt supplies?

What is the difference between Nil Rated, Zero Rated and Exempt supplies? There is a confusion among taxpayers as to what is the difference between Nil Rated, Zero Rated, and Exempt…

Is composition dealer required to file GSTR-3B?

Is composition dealer required to file GSTR-3B? Many dealers registered under composition scheme has the query, as to whether they are required to file GSTR-3B or not? Answer - Composition…

GST For Janta – GSTR3B Guide

Date of filing GSTR-3B is near and there is a lot of confusion among taxpayers as to how the return filing mechanism will work. GSTR3B is the provisional return form…

What if any invoice gets missed in GSTR-3B?

What if any invoice gets missed in GSTR-3B? Currently, One of the hot questions in relation to GSTR-3B is that if any invoice data gets missed while filing return, then…

GST Slab rationalisation will depend on rise in revenue collection

As reported by The Indian Express, Arjun Ram Meghwal, Union Minister of State in Finance and Corporate Affairs, said that Rationalisation of tax slabs under GST would depend on the rise in…

Clarifications in relation to furnishing of Bond/LUT for exports

Circular has been issued by CBEC to clarify the issues in relation to furnishing of Bond/Letter of Undertaking for Exports. Circular mentions that varied interpretation have been received from exporters…

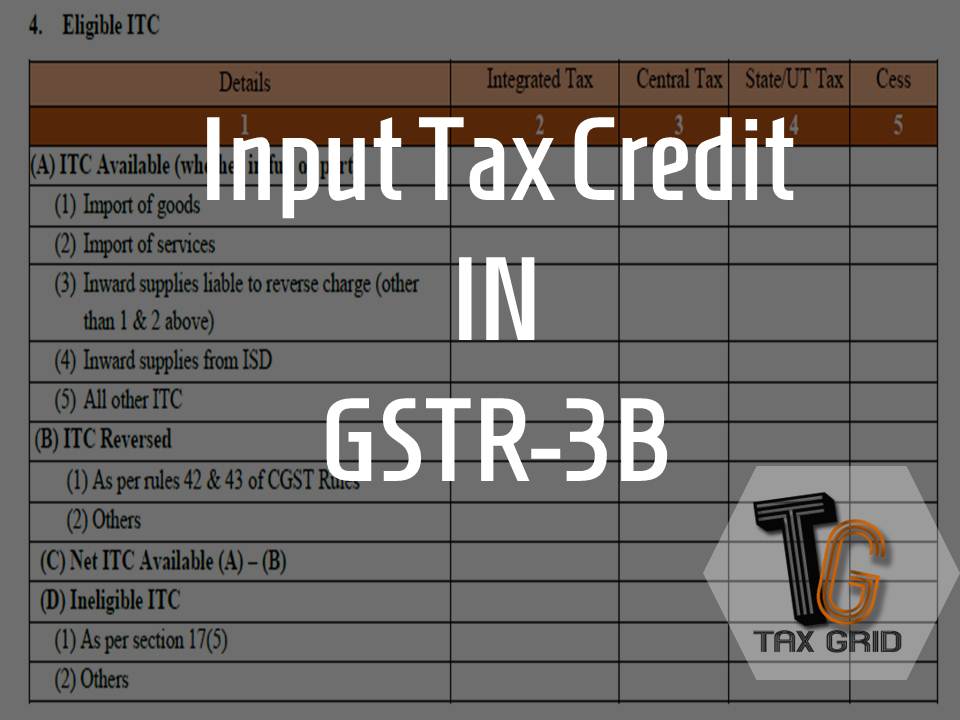

ITC under form GSTR-3B

It's time to file GSTR-3B soon and the taxpayers are getting confused as to how they can avail Input Tax Credit (ITC) in Return GSTR-3B. Another question because of which…

Continuation of Pre-GST rates of Rebate of State Levies

Circular has been issued by CBEC stating the continuation of pre-GST rates of Rebate of State Levies (ROSL) for transition period of three months to for Export of Garments and…