Author Archives: taxgrid - Page 8

Advance ruling- Steps to be followed to seek an hearing

There are many taxpayers who are of whish to obtain Advance Ruling before proceeding with their business in the tax regime or maybe even registered taxpayers might want to seek…

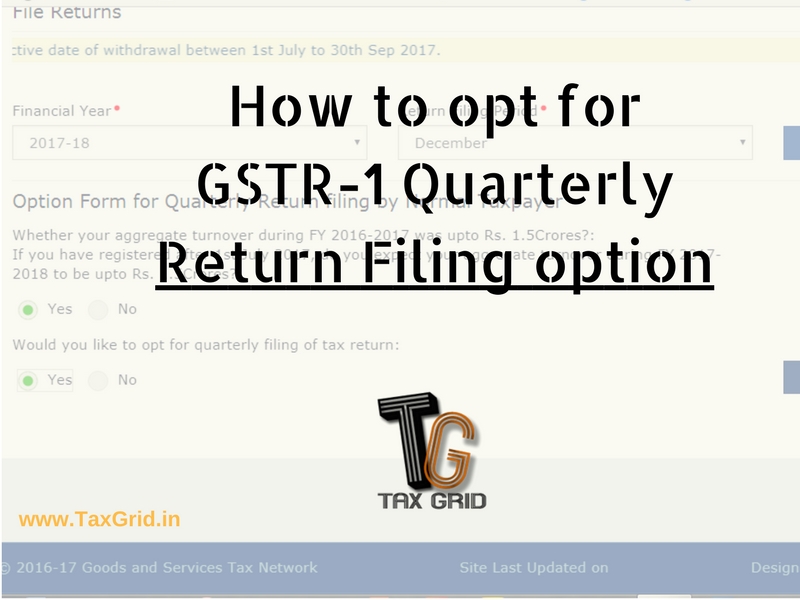

How to opt for GSTR-1 Quarterly Return Filing option

The government has recently enabled a facility for taxpayers with turnover less than crores to file the Form GSTR1 quarterly instead of filing it every month. This option has provided…

Last date to file Form GSTR-5A in respect of OIDAR extended

Last date to file FORM GSTR-5A for the months of July, 2017, August, 2017, September, 2017, October, 2017, November, 2017 and December, 2017 has been extended till 31st January, 2018.…

Last date to file Form GSTR-5 by non-resident taxable person extended

Last date to file Form GSTR-5 by non resident taxable person has been extended till 31st January, 2018. This extension has been done in the respect of the return for…

Last date to file form GST ITC-01 extended till 31st January, 2018

Last date for filing of Form GST ITC-01 has been extended till 31st January, 2018 vide Notification No. 67/2017 – Central Tax. Read the notification below:

FAQ’s on Electronic Way Bill

Frequently Asked Questions (FAQs) on e-way bill 1. What is an e-way bill? e-way bill is a document required to be carried by a person in charge of the conveyance…

Now data furnished in GSTR1 in previous period can be amended by table 9

GSTN has enabled the functionality to provide the amendments to the invoices/debit or credit note furnished in previous periods through table 9 in GSTR1. No taxpayers can use table 9…

Now quarterly GSTR-1 can be filed on portal

It was notified by the government that now the taxpayers whose turnover is below crores will be required to furnish the quarterly GSTR1 return till March 2018 instead of monthly…

Supplies by Restaurants under GST

Since GST has been implemented, various industry-specific issues have been constantly arising and Restaurants are one of them. There have been various viewpoints regarding taxation of supplies by restaurants under…

E-way bill to be implemented across India by

PIB (Release ID :174401): The 24th Meeting of the GST Council held today through video conference under the Chairmanship of the Union Minister of Finance and Corporate Affairs, Shri Arun Jaitley. It…