How to opt for GSTR-1 Quarterly Return Filing option

The government has recently enabled a facility for taxpayers with turnover less than 1.5 crores to file the Form GSTR1 quarterly instead of filing it every month. This option has provided ease to many taxpayers but there is one problem which is being faced by some of the taxpayers i.e. irreversibility of the choice once taken. GSTN portal provides the taxpayer with the option that if his Aggregate turnover is less than 1.5 crores, he can choose to file the quarterly or monthly return as per his wish. Some taxpayer falling into the category of turnover less than Rs 1.5 crores has by mistaken chosen the monthly return filing option which now cannot be reversed and thus again leads to huge compliance ( You can refer the thread at https://taxgrid.in/forums/topic/chose-the-option-to-file-monthly-return-instead-of-quarterly-return-what-to-do/). So in this article, it is shown step by step with the help of screenshots that how you can opt the quarterly return filing option on the portal.

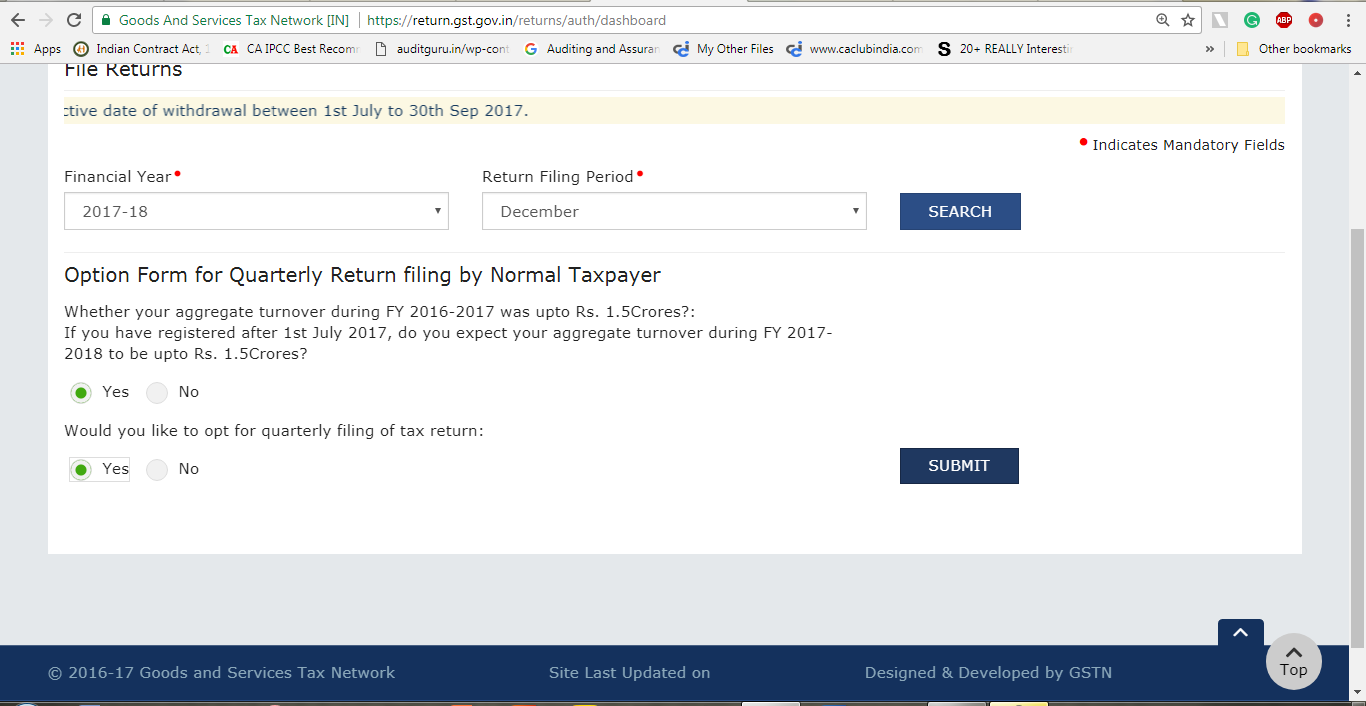

So, after you log into the GSTN common portal www.gst.gov.in and proceed towards your Return Dashboard. You will be prompted with the following screen. IF you are willing to opt for Quarterly return, just select “Yes”, in both the options.

After you select yes for the first option, the second option is displayed asking that whether you would like to opt for quarterly filing of tax returns or not. Select “Yes” if you want to file returns quarterly. Be careful, as many taxpayers have selected the first option to be “YES” even if their turnover was less than or equal to Rs 1.5 Crore.

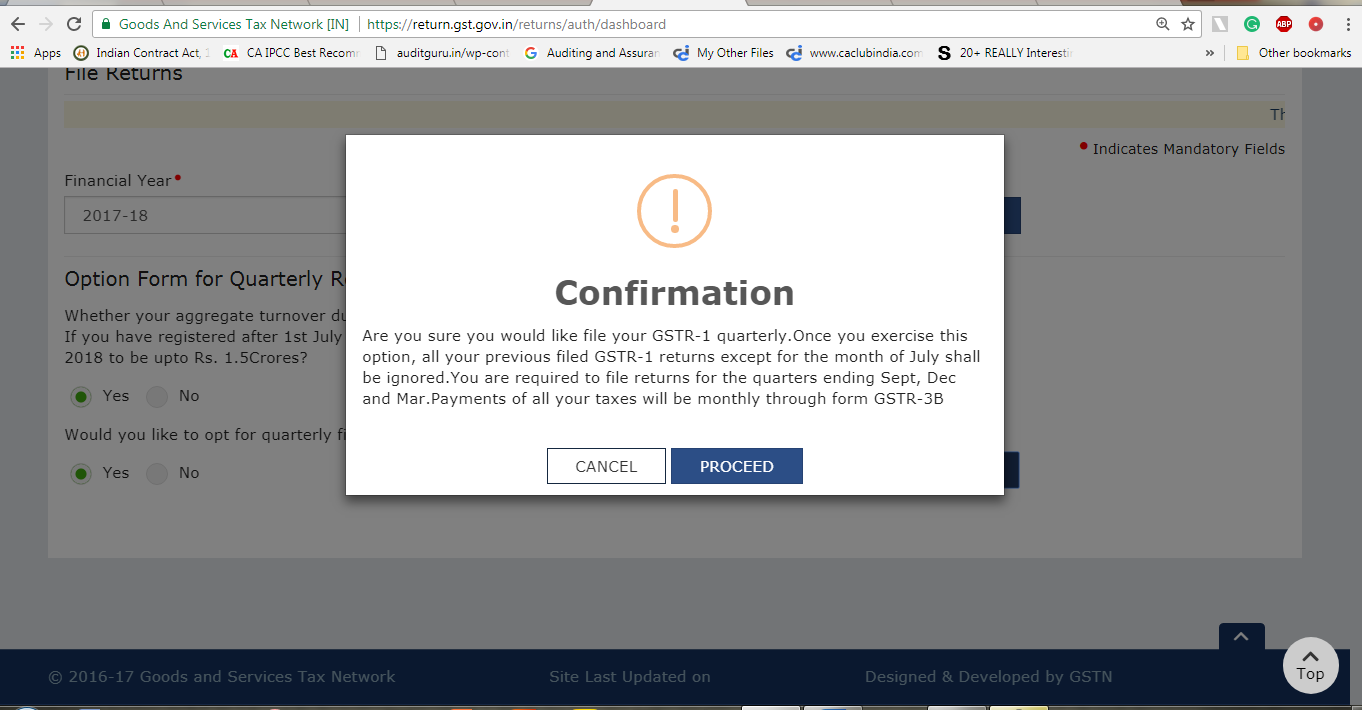

After the selection is made, portal asks for confirmation and displays the message that once the option is selected then return will have to be filed quarterly with tax payments monthly through FORM GSTR3B. The data furnished in GSTR1 of July shall be auto-filled in the quarterly return for the period of the quarter ending in September. The confirmation message is displayed as below:

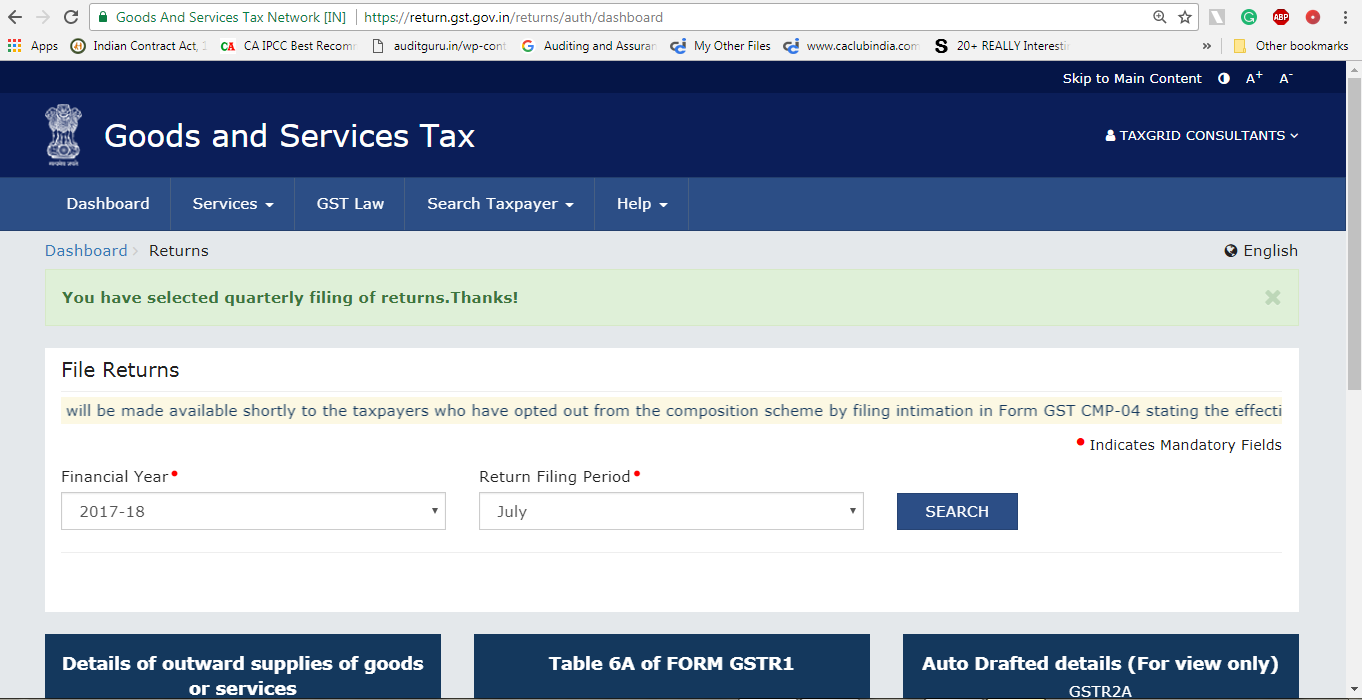

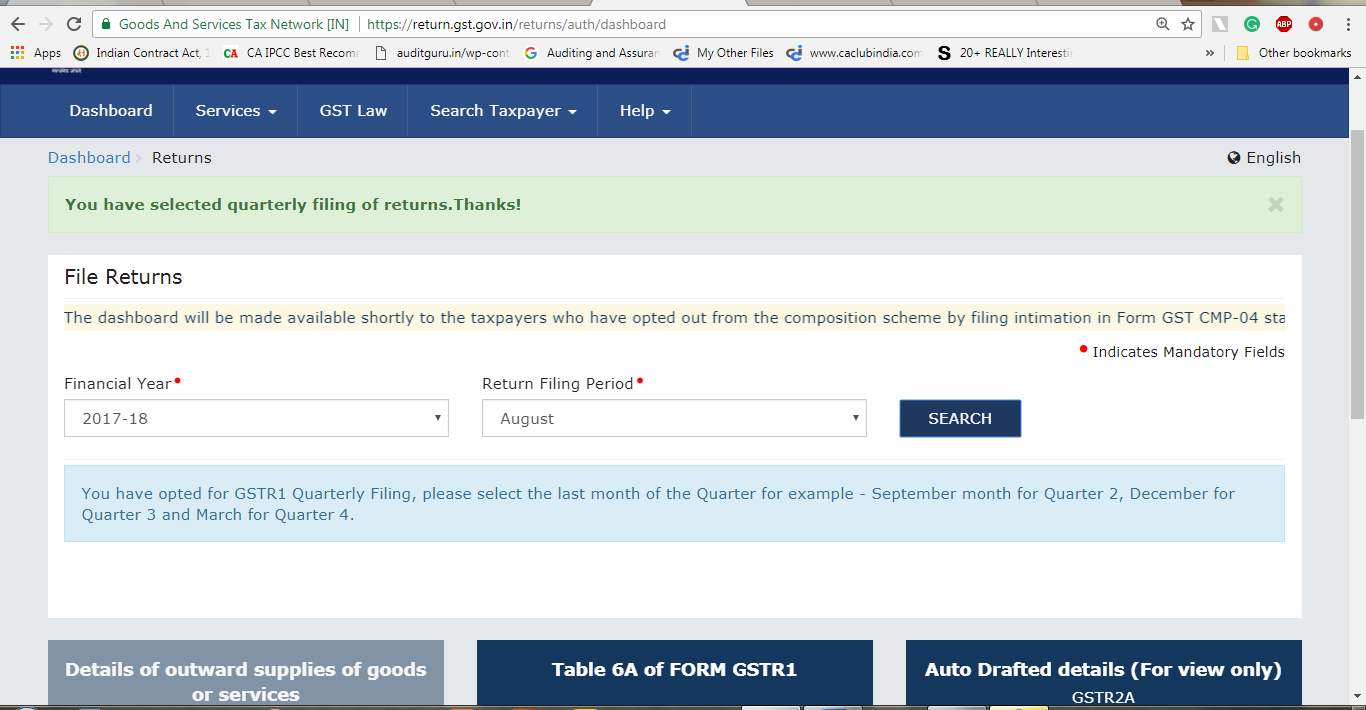

After that, the message is displayed showing that the quarterly filing of returns has been selected.

Now you can proceed to return filing. The options are not shown for selecting as “July-September” or “October – December” as are shown in case of GSTR4. In this case, to file the quarterly return, you need to select the last month of the quarter for which you want to file the return. Like to file the return for the quarter “July- September” you need to select the month as September.

jashon file kaise banaye???

august me gstin no liya hai usika gstr1 me financial year ke liye turnover bhejana padta hai vo kaise upload kare??

sir

can i include august invoices which was omitted to add in jul-sep GSTR-1 IN THE

LAST QUARTER GSTR-1 JAN-MAR PLEASE CLARIFY

THANKS

Dear sir , I have not filled GST RETURNS from August and i have been opted for quarterly return filling.So, please kindly help me in this issue

hello

By mistake i have opted monthly gstr1. how can i change to monthly to quartely . pl send the reply to the email