Archives for GST- Articles - Page 3

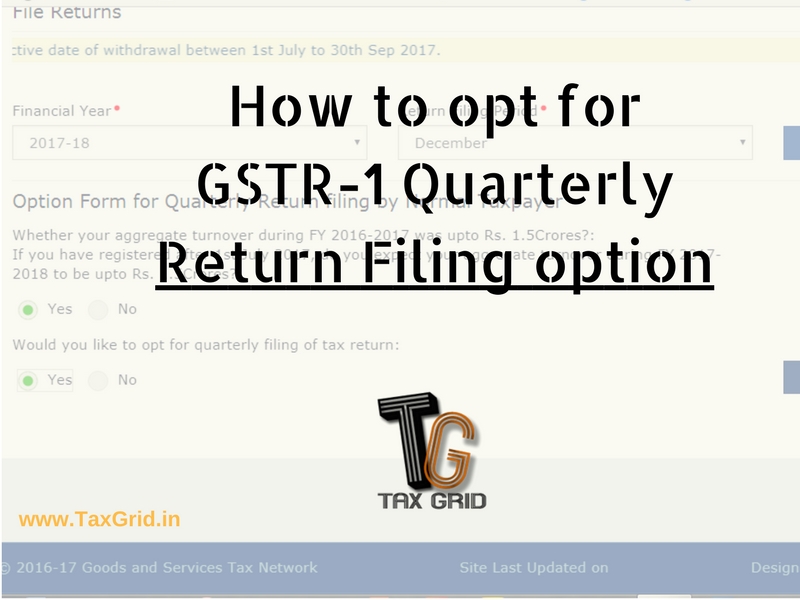

How to opt for GSTR-1 Quarterly Return Filing option

The government has recently enabled a facility for taxpayers with turnover less than crores to file the Form GSTR1 quarterly instead of filing it every month. This option has provided…

FAQ’s on Electronic Way Bill

Frequently Asked Questions (FAQs) on e-way bill 1. What is an e-way bill? e-way bill is a document required to be carried by a person in charge of the conveyance…

Supplies by Restaurants under GST

Since GST has been implemented, various industry-specific issues have been constantly arising and Restaurants are one of them. There have been various viewpoints regarding taxation of supplies by restaurants under…

How the excess balance amount in cash ledger paid wrongly through challan will be refunded

It's been almost five and a half month since GST has been implemented and still, we are in the stage of the returns cycle for the month of July. However,…

ANALYSIS OF PROPOSED AMENDMENTS IN COMPOSITION SCHEME IN GST COUNCIL MEETING

By CA Parampreet Khurana The GST Council in its the 22nd meeting held on 6 October 2017 has brought in necessary changes in its composition scheme. The Government has extended…

What was the confusion regarding last date of filing FORM GST TRAN-1?

Why taxpayers got confused as to what is the last date of filing FORM GST TRAN-1 owing to the consecutive press release, notification, and order issued by CBEC? Many taxpayers…

FAQs in relation to GSTR-3B return filing

It is more than month now that GST has been implemented and people have been struggling with the new law. Also the confusion is getting worse as the date of return…

GSTN launching Offline Utility

GST is all set to roll out from 1 July and the corporate sector is trying to cope with new tax regime at its best. GSTN (Goods and Service Tax…