Archives for GST-diagram presentations

Filing of GSTR-3B and transitional credit

Following Infographic was released on twitter today CBEC to bring more clarity among taxpayers:

GST Impact on Manpower Service Industry

GST Impact on Manpower Service Industry Find the short PPT complied at TaxGrid. Get to know the Impact of GST on Manpower service providers under GST. This presentation was designed…

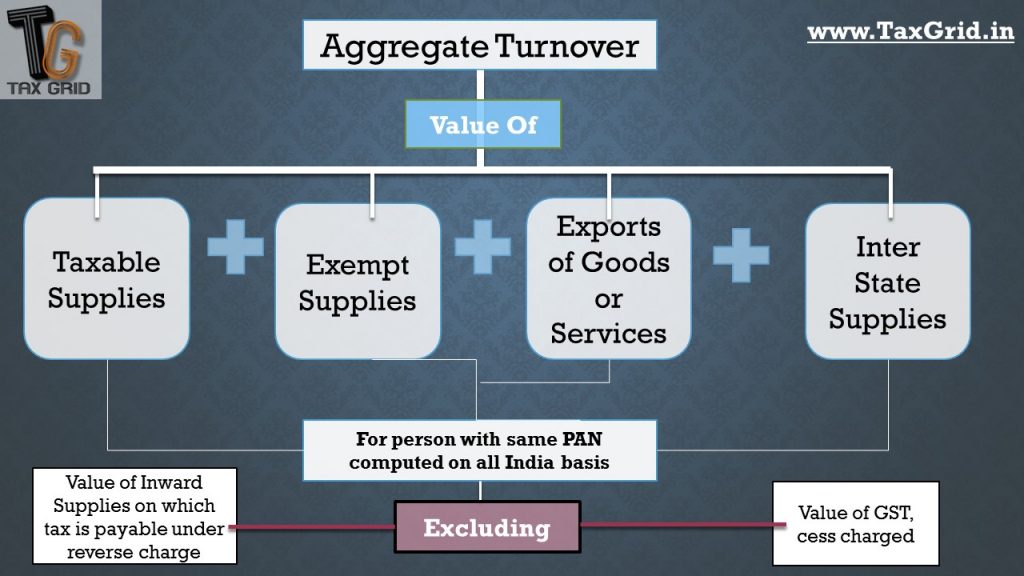

Aggregate turnover

Section 2(6) “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis),…

GST for Janta

GST FOR JANTA Find the short E-book complied at TaxGrid. Get to know the basics of GST with our E-book series GST For JANTA. Topics Covered under This part Taxablity…

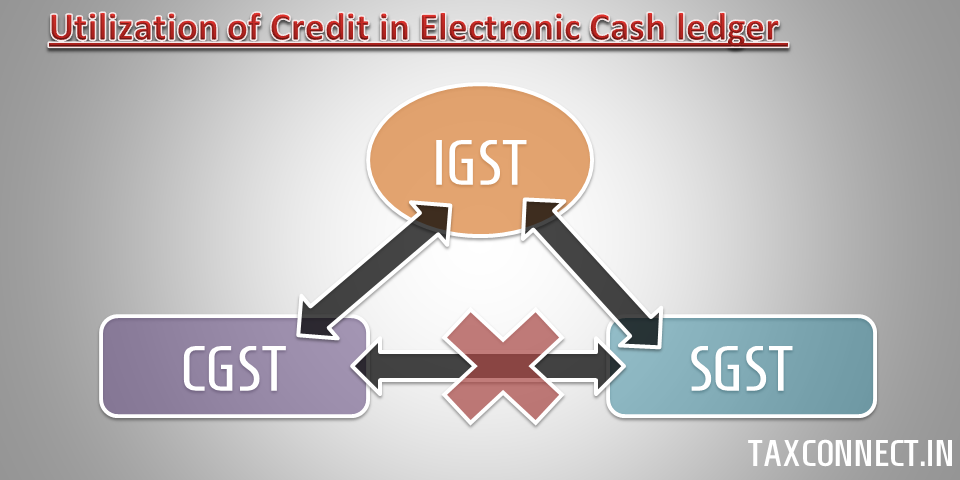

Utilization of Credit- obsolete

Section 44(5)(a) can be interpreted clearly with the help of diagrammatic representation above. Sec 44(5) - (a) The amount of input tax credit on account of IGST available in the electroniccredit ledger…

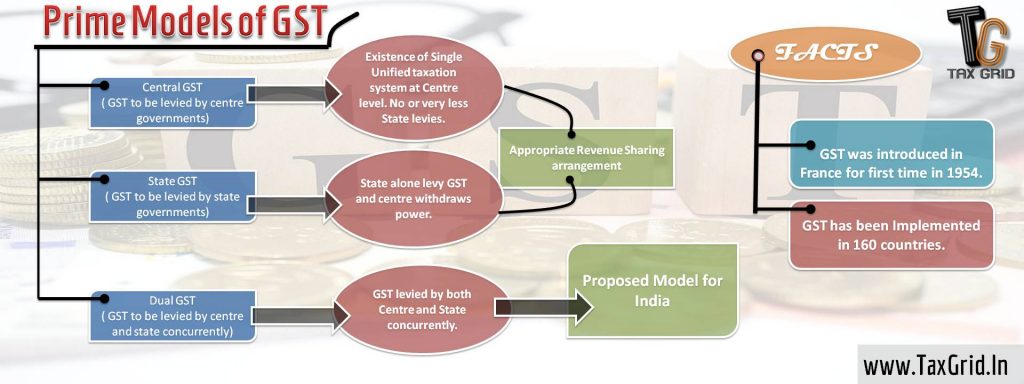

Prime Models of GST

Three Models of GST can be: Central GST ( CGST) State GST (SGST) Dual GST The overview of these can be taken through the above image. For detailed explanation regarding…