Archives for GST portal - Page 3

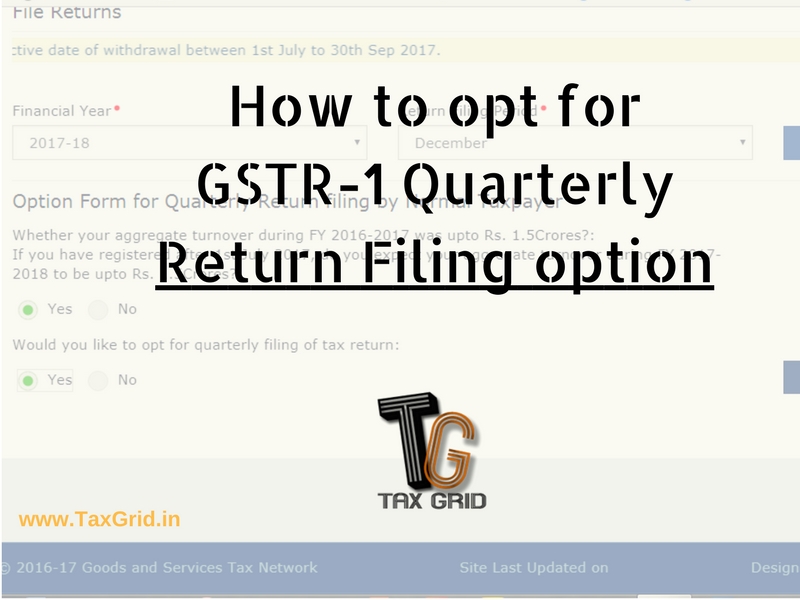

How to opt for GSTR-1 Quarterly Return Filing option

The government has recently enabled a facility for taxpayers with turnover less than crores to file the Form GSTR1 quarterly instead of filing it every month. This option has provided…

Now data furnished in GSTR1 in previous period can be amended by table 9

GSTN has enabled the functionality to provide the amendments to the invoices/debit or credit note furnished in previous periods through table 9 in GSTR1. No taxpayers can use table 9…

Now quarterly GSTR-1 can be filed on portal

It was notified by the government that now the taxpayers whose turnover is below crores will be required to furnish the quarterly GSTR1 return till March 2018 instead of monthly…

Late fee showing up on resetting for the months it was waived off

Some taxpayers are facing the issue upon opting for reset of GSTR3B. Upon resetting the return late fee becomes visible for the month it was waived off. However, GSTN has…

Error report showing “YOU HAVE ALREADY OFFSETTED GSTR-3B”

Some Taxpayers are not able to reset and file GSTR-3B because they face the error report showing "YOU HAVE ALREADY OFFSETTED GSTR-3B", however, cess liability is yet to be set off.…