Archives for GST - Page 11

Is your ERP GST Compatible??

The most important question before welcoming GST ( Goods and Service Tax) which is yet to be answered by most of the companies in every industry is "Is your ERP…

E-way Bill

E-way Bill Find the short note on E-way Bill contributed by TaxGrid Member. Contributed by Sahil Your comments and feedback are welcome. Use the feedback form in the sidebar or…

GST for Janta

GST FOR JANTA Find the short E-book complied at TaxGrid. Get to know the basics of GST with our E-book series GST For JANTA. Topics Covered under This part Taxablity…

Composition Scheme

Big organizations are finding new avenues and interpretations in the Goods and Service Tax (GST) regime to plan their tax liability to their benefit. GST is expected to ease the…

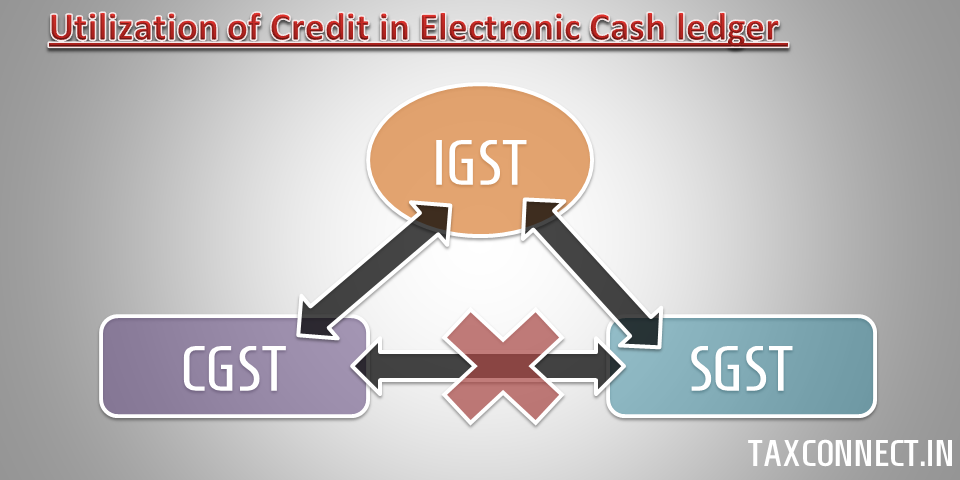

Utilization of Credit- obsolete

Section 44(5)(a) can be interpreted clearly with the help of diagrammatic representation above. Sec 44(5) - (a) The amount of input tax credit on account of IGST available in the electroniccredit ledger…

GST Timeline

Find the complete timeline about how GST was introduced and the actions which made the way possible towards its implementation.

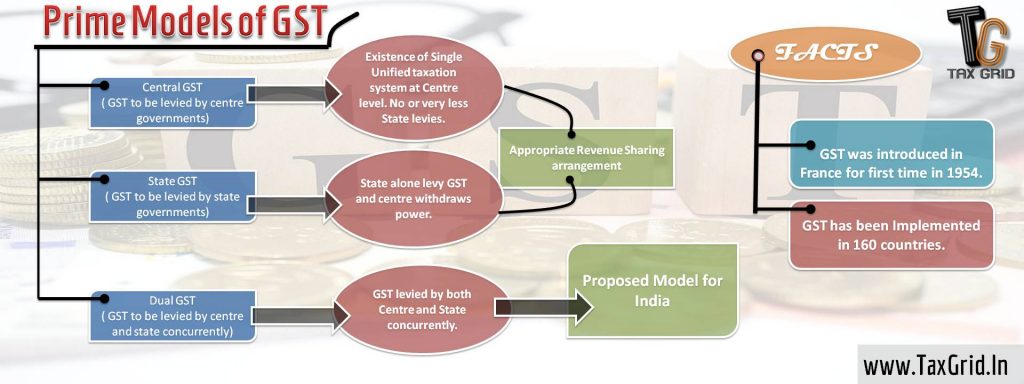

Prime Models of GST

Three Models of GST can be: Central GST ( CGST) State GST (SGST) Dual GST The overview of these can be taken through the above image. For detailed explanation regarding…

Transition to GST – Action points

Transition to GST - Action points GST being largest indirect tax reform in history of India is on verge of its implementation. Every business, small or big will get impacted…

FAQs on GST

Step by Step Guide for GST Enrolment for existing Central Excise / Service Tax Assessees The Gazette of India after GST bill received President assent Notice of amendment on The…