Tag archives for cgst

ANALYSIS OF PROPOSED AMENDMENTS IN COMPOSITION SCHEME IN GST COUNCIL MEETING

By CA Parampreet Khurana The GST Council in its the 22nd meeting held on 6 October 2017 has brought in necessary changes in its composition scheme. The Government has extended…

GST Tech FAQ’s for guidance to amend the fields on GST Portal

Read various FAQs released by GSTN on Twitter through its GST Tech Twitter handle. These FAQs guide taxpayers for amending various fields on GST Common Portal.

Notification regarding waiving of late fee on GSTR-3B

Earlier in the press release, it was communicated that Late fee won't be levied on the returns for the interim period, to give the sense of comfort to taxpayers, but…

Clarification on classification and GST rate on lottery

Circular has been issued by CBEC clarifying classification and GST rate on lottery tickets. Read the circular below. Clarification on classification and GST rate on lottery Date for filing of…

Notification regarding GTA and LLP

In the recent 20th meeting, GST Council took some decisions for which the notification has been issued by CBEC today. Read the notification so released below - Notification No. 22/2017-…

Central Goods and Services Tax (Fifth Amendment) Rules, 2017 notified

CBEC has notified Central Goods and Services Tax (Fifth Amendment) Rules, 2017 via Notification No. 22/2017 – Central Tax. You can read the notified amendment rules below and the TaxGrid…

What is the difference between Nil Rated, Zero Rated and Exempt supplies?

What is the difference between Nil Rated, Zero Rated and Exempt supplies? There is a confusion among taxpayers as to what is the difference between Nil Rated, Zero Rated, and Exempt…

GST and Exports

GST and Exports Find the latest document released by CBEC in relation to exporters in GST. Read Online. Use the feedback form in the sidebar or contact us page to…

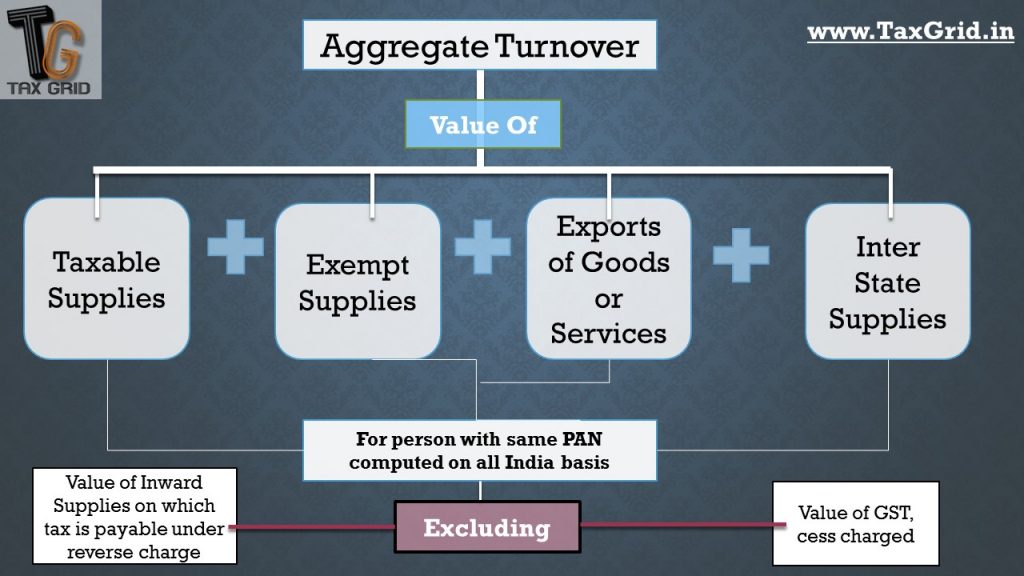

Aggregate turnover

Section 2(6) “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis),…

E-way Bill

E-way Bill Find the short note on E-way Bill contributed by TaxGrid Member. Contributed by Sahil Your comments and feedback are welcome. Use the feedback form in the sidebar or…