Tag archives for gst - Page 3

What if any invoice gets missed in GSTR-3B?

What if any invoice gets missed in GSTR-3B? Currently, One of the hot questions in relation to GSTR-3B is that if any invoice data gets missed while filing return, then…

GST Slab rationalisation will depend on rise in revenue collection

As reported by The Indian Express, Arjun Ram Meghwal, Union Minister of State in Finance and Corporate Affairs, said that Rationalisation of tax slabs under GST would depend on the rise in…

GST and Exports

GST and Exports Find the latest document released by CBEC in relation to exporters in GST. Read Online. Use the feedback form in the sidebar or contact us page to…

GSTN to launch helpline for taxpayers, officials on Jun 25

New Delhi, Jun 22 (PTI) GST Network, the company providing IT backbone for the GST, will launch two call centres on Sunday to handle queries from taxpayers and tax officials.…

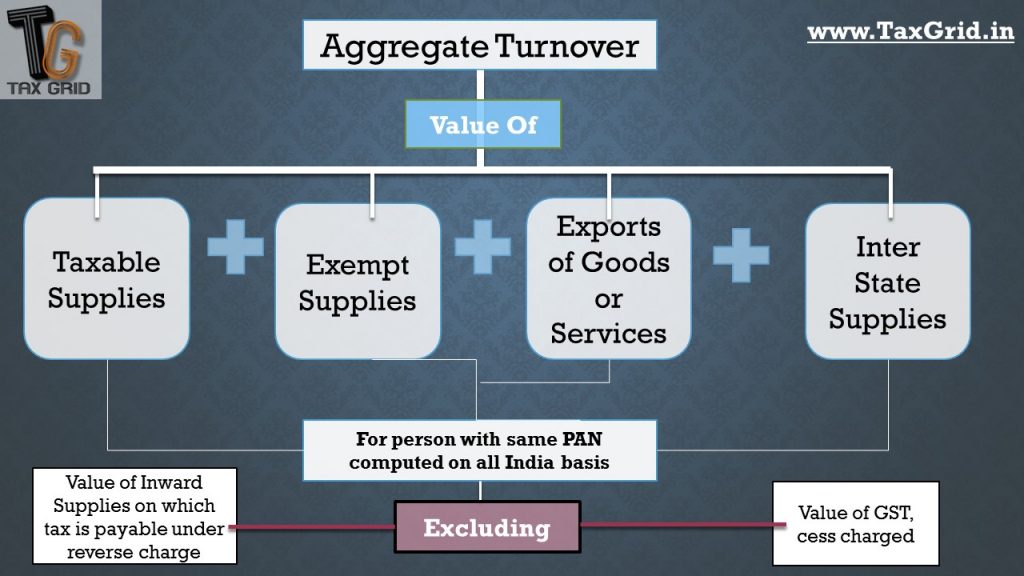

Aggregate turnover

Section 2(6) “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis),…

GSTN launching Offline Utility

GST is all set to roll out from 1 July and the corporate sector is trying to cope with new tax regime at its best. GSTN (Goods and Service Tax…

Frequently Asked Questions (FAQs) for GST

Find out the Latest FAQs published by CBEC in English language GST – CONCEPT & STATUS – As on 5th April, 2017 Step by Step Guide for GST Enrolment for…

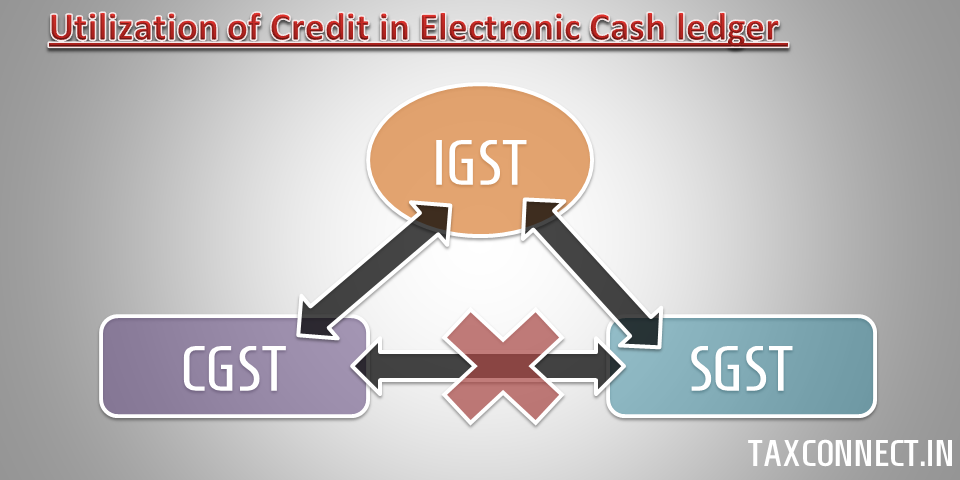

Utilization of Credit- obsolete

Section 44(5)(a) can be interpreted clearly with the help of diagrammatic representation above. Sec 44(5) - (a) The amount of input tax credit on account of IGST available in the electroniccredit ledger…

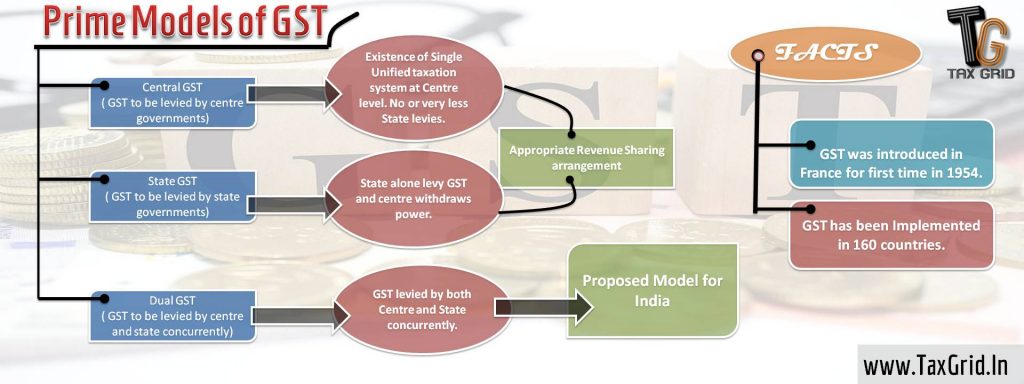

Prime Models of GST

Three Models of GST can be: Central GST ( CGST) State GST (SGST) Dual GST The overview of these can be taken through the above image. For detailed explanation regarding…

Transition to GST – Action points

Transition to GST - Action points GST being largest indirect tax reform in history of India is on verge of its implementation. Every business, small or big will get impacted…