Tag archives for input tax credit

New return design for GST return approved

GST council has approved the new return design for GST based on the recommendations of the group of ministers on IT simplification. As per the new return design, returns shall…

Six months of Goods and Services Tax in India

Six months of Goods and Services Tax in India and Way Forward By Priyanshu Goyal The midnight of 1st July 2017 experienced the future changing historic tax reform in India…

ITC-01 enabled on GST portal for availing ITC in various cases

ITC 01 is now enabled on portal for availing Input Tax Credit in various situations like the one illustrated below: Registered persons whose exempt supply of goods and/or services become…

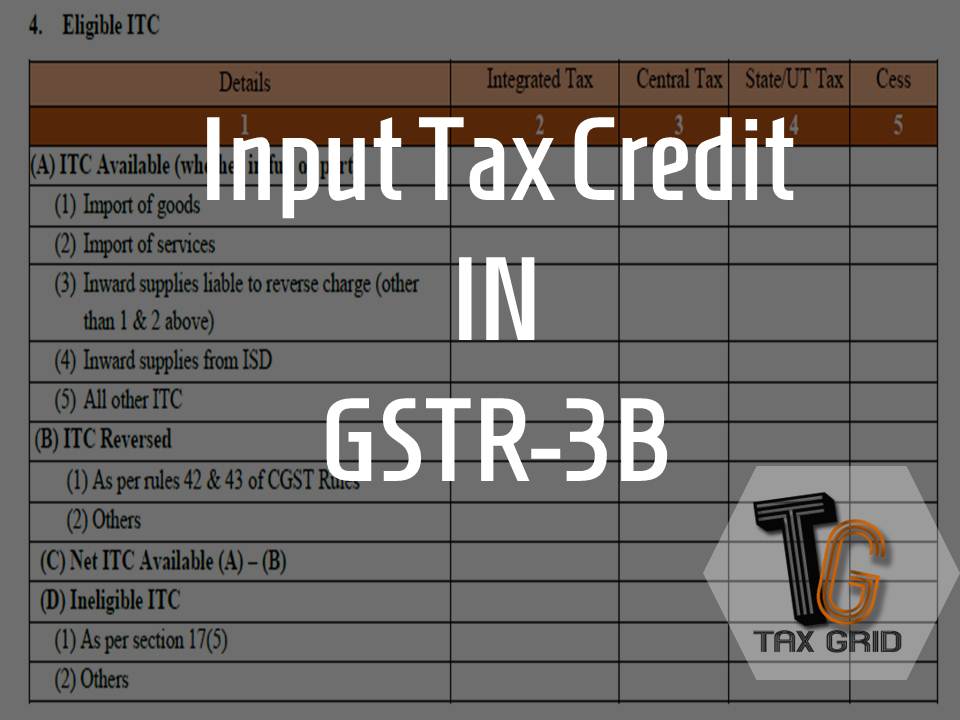

Is transitional ITC to be declared in GSTR-3B?

Is transitional ITC or closing ITC balance of June to be declared in GSTR-3B? The major question which dealers are facing in GST regime is whether the transitional ITC or…

ITC under form GSTR-3B

It's time to file GSTR-3B soon and the taxpayers are getting confused as to how they can avail Input Tax Credit (ITC) in Return GSTR-3B. Another question because of which…

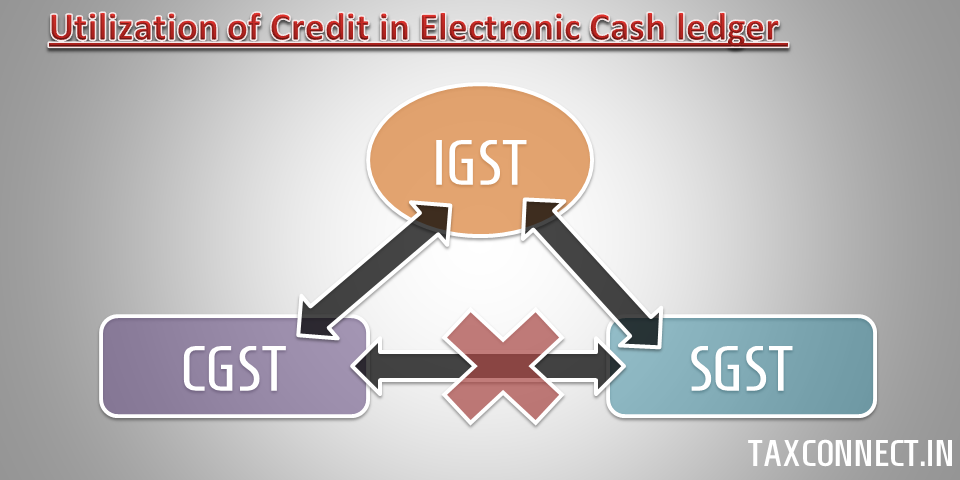

Utilization of Credit- obsolete

Section 44(5)(a) can be interpreted clearly with the help of diagrammatic representation above. Sec 44(5) - (a) The amount of input tax credit on account of IGST available in the electroniccredit ledger…