Search result for " refund "

Features of Special drive Refund Fortnight by Governments

Second "Special drive Refund Fortnight" will be started by Government from 31st May 2018 to 14th June 2018. In the press release made by Ministry of Finance, it has been…

Everything about availability of refunds under section 55

Availability of refunds under section 55 Read below to know everything about the availability of refunds under section 55 in brief. Refunds under section 55 Section 55 of the CGST (Central…

Input Tax Refund to Exporters to be speeded up

Government has decided to speed up input tax refund to exporters. As per rule 91 of CGST Rules, 2017, ninety per cent of the refund amount claimed shall be granted…

Refund of IGST amount paid on exports not received

Many taxpayers have been complaining of not receiving the refund of IGST amount paid on exports. So, what is the possible solution for that? The one possible reason for this…

Government says mistakes by exporters is the reason for delay in refund

In the press release made by Ministry of Finance, it has been expressed by the government that errors being made by exporters in filing their returns is the sole reason…

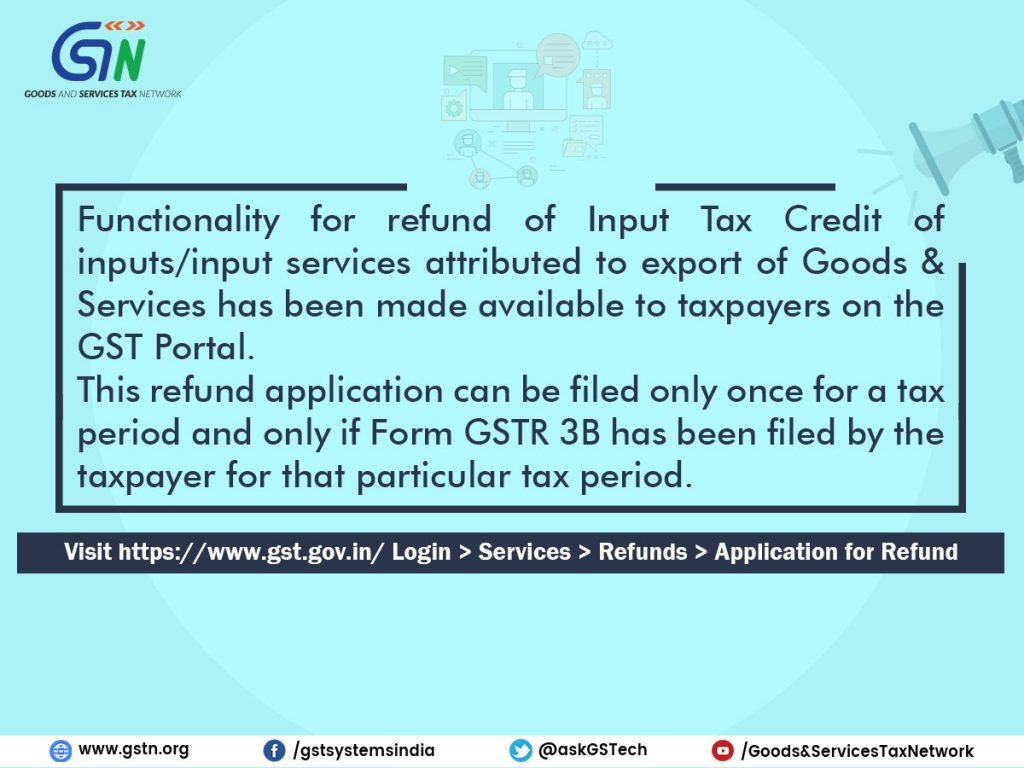

Functionality for refund of Input Tax Credit of inputs/input services attributed to export of Goods & Services is now available on the GST Portal

Functionality for refund of Input Tax Credit of inputs/input services attributed to export of Goods & Services is now available on the GST Portal.

How the excess balance amount in cash ledger paid wrongly through challan will be refunded

It's been almost five and a half month since GST has been implemented and still, we are in the stage of the returns cycle for the month of July. However,…

Advance Ruling – Olety Landmark Apartment Owner’s Association – KAR ADRG 12/2021

Analysis of the advance ruling given by ARA of the state of Karnataka in the case of M/s Olety Landmark Apartment Owner's Association dated has been prepared for easy reference…

Can GST officer purchase the goods or services to test compliance?

Question - Can GST official test purchase the goods or services from any person to check the compliance of GST? Answer - Yes, such test check can be undertaken to…

Zero rated supply

Section 16 of IGST Act defines Zero rated supply as follows: (1) “zero rated supply” means any of the following supplies of goods or services or both, namely:–– (a) export…