Refund of IGST amount paid on exports not received

Many taxpayers have been complaining of not receiving the refund of IGST amount paid on exports. So, what is the possible solution for that?

The one possible reason for this is the mismatch between the data furnished in GSTR3B and the data furnished in GSTR1. It is necessary to make sure that the data furnished in table 3.1 (b) of GSTR3B is correct in order to get the refund. In this regard, three points have been communicated by GSTN:

- GSTR3B of the corresponding period must have been filed for which the refund is being sorted

- IGST amount should have been paid through table 3.1 (b) of GSTR3B and must be equal to (or greater than) the total IGST amount shown to have been claimed under table 6A and table 6B of GSTR-1 for the corresponding tax period. As the GSTR3B is the return in which currently summary is being furnished and also the payment is made through GSTR3B, it is important that the details furnished in GSTR3B are correct.

- If correct IGST amount is not filed in table 3.1(b) of GSTR3B, then NONE of the invoice filed in table 6A of GSTR3B shall be transmitted to ICEGATE resulting in blockage of refund of IGST amount paid on exports. So, it is important that the amount furnished in GSTR3B is equal or greater than the amount being declared in GSTR1.

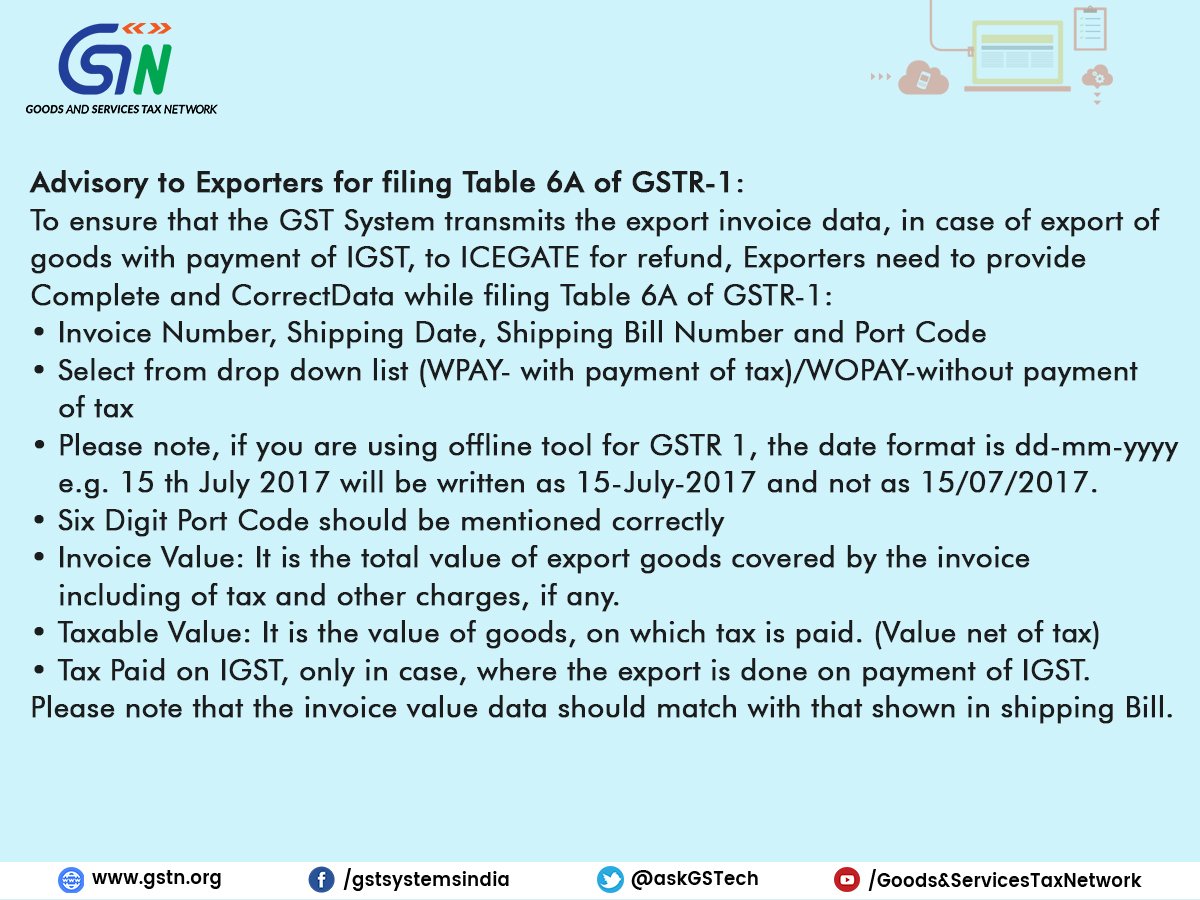

Further, it is also important that the data provided in Table 6A of GSTR1 is correct and complete for proper transmission to ICEGATE from GST system and for this, the following checks need to be taken care of:

- Invoice Number, Shipping Date, Shipping Bill Number and Port Code

- Select from drop down list (WPAY- with payment of tax)/WOPAY-without payment of tax

- Please note, if you are using offline tool for GST R 1, the date format is dd-mm-yyyy e.g. 15th July 2017 will be written as 15-July-2017 and not as 15/07/2017.

- Six Digit Port Code should be mentioned correctly

- Invoice Value: It is the total value of export goods covered by the invoice including of tax and other charges if any.

- Taxable Value: It is the value of goods, on which tax is paid. (Value net of tax)

- Tax Paid on IGST, only in case, where the export is done on payment of IGST.

- Please note that the invoice value data should match with that shown in shipping Bill.

Check out all the latest news and articles related to IGST refund on TaxGrid.

Leave a Reply