Tag archives for gstr3b

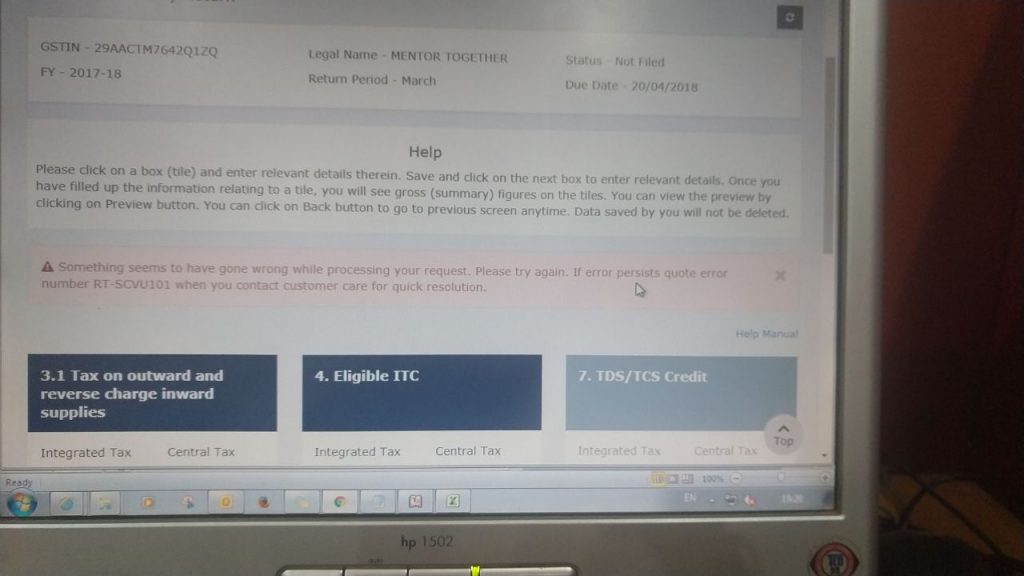

Error RT-SCVU101

error RT-SCVU101 Taxpayers have been facing Error RT-SCVU101 while saving the data in FORM GSTR3B. Error reads out Something seems to have gone wrong while processing your request. Please try again.…

NET ITC Provided is not equal to ITC Available RET3B91404

NET ITC Provided is not equal to ITC Available - ITC Reversed. If error persists quote Error Number RET3B91404 GSTN has now simplified the GSTR3B filing process wherein the submit…

Notification released waiving the late fees for the month of September and august

CBEC issues Notification No. 50/2017 – Central Tax– wherein late fee payable under section 47 of Central Goods and Services Tax Act in case of late filing of return after…

Press Release: GST Revenue collection Figure and Waiver of Late fee

Press Release regarding Waiving of late fee on filing of GSTR3B for August and September and GST revenue collection Figure. GST Revenue Figures – As on 23rd October, 2017 The…

GSTR3B Offline Utility Launched

GST3B offline utility has been launched by GSTN to help taxpayers file the return offline. The excel based GSTR3B offline utility is designed to help the taxpayer to prepare the GSTR3B…

Why is late fee being shown up in GSTR3b for september

Taxpayers are facing the new confusion by finding the amount of Late fee in the return GSR3b for the month of September even when the last date to file the return…

FAQs with regard to new return filing mechanism for taxpayers with turnover less than 1.5 crore

Got any questions with regard to the new mechanism of return filing for taxpayers with turnover less than crores? Find the answers below and comment if still, any question goes…

Government issues new GST Revenue Figures

Ministry of Finance made the press release today issuing the new figures of revenue from GST. As said in the press release the revised figure of GST revenue for the…

Blockage of Working Capital of Exporters

Ministry of Finance makes clarifies that the apprehension being expressed regarding the blockage of working capital for exporters in GST regime and media reports relating to this are not based…

Now taxpayers can edit GSTR3B

In the recent tweet, GSTN (Goods and Services Tax Network) released a poster claiming that now Taxpayers who have not set off their tax liability for GSTR3B for July 2017 and…