Archives for 2018 - Page 2

Features of Special drive Refund Fortnight by Governments

Second "Special drive Refund Fortnight" will be started by Government from 31st May 2018 to 14th June 2018. In the press release made by Ministry of Finance, it has been…

FAQs on GSTR5A

GSTR5A Following are few of the common Questions asked by the taxpayers liable to file GSTR5A : Question 1: What is GSTR-5A? Answer - GSTR-5A is a Return to be furnished by…

New return design for GST return approved

GST council has approved the new return design for GST based on the recommendations of the group of ministers on IT simplification. As per the new return design, returns shall…

Goods sent to job worker under GST not returned

Question - If goods sent to job worker under GST are not returned within the time stipulated in section 143, then how to deal with the situation? Answer - If…

Paperless Indian Customs:e-SANCHIT

Indian Customs has gone paperless with the help of e-SANCHIT. What is e-SANCHIT? e-SANCHIT is a paperless processing application, which facilitates the trade for submitting all required supporting documents for…

GST revenue collection for the Financial Year 2017-18

GST revenue collection in the period between August 2017 and March 2018 has been Rs. lakh crore. Press release by Ministry of Finance indicated the collection figures for the financial…

5 more states will be rolling out E-way bill from tomorrow

As communicated by Ministry of Finance, 5 more states will be rolling out E-way bill from tomorrow. Previously intra-state E-way bill has been rolled out in twelve states. Now introducing…

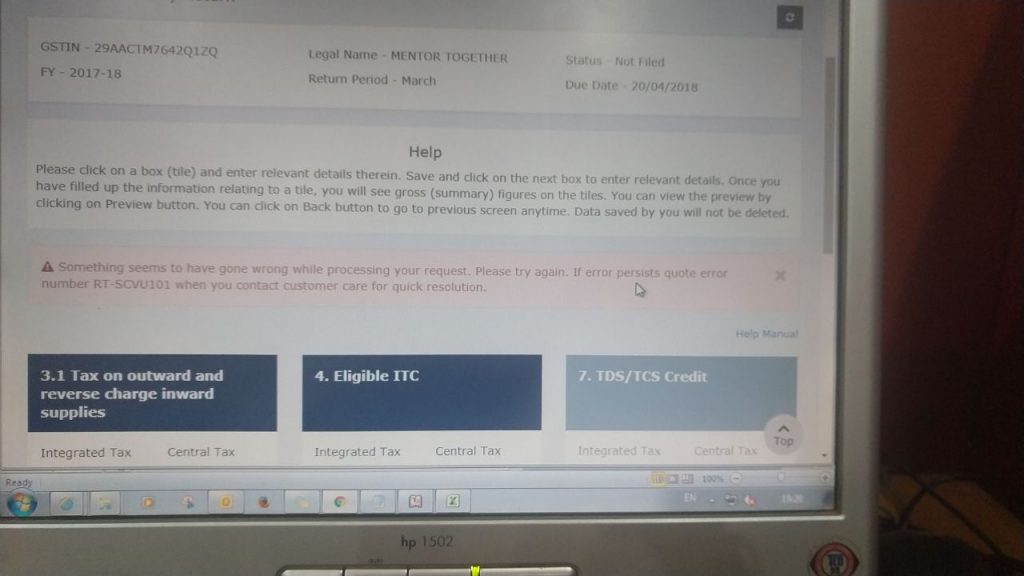

Error RT-SCVU101

error RT-SCVU101 Taxpayers have been facing Error RT-SCVU101 while saving the data in FORM GSTR3B. Error reads out Something seems to have gone wrong while processing your request. Please try again.…

Final return in GST

Final Return in GST Notification No. 21/2018 – Central Tax Central Board of Indirect Taxes and Customs on 18th April 2018 vide Notification No. 21/2018 – Central Tax notified the FORM GSTR-10…

Intrastate e-way bill will be applicable in Maharashtra from 1 May 2018

As notified vide Notification No. 15B/2018 –State Tax of COMMISSIONER OF STATE TAX, MAHARASHTRA STATE, Intrastate e-way bill will be applicable in Maharashtra from 1 May 2018. Vide NOTIFICATION No. 15A/2018 –State Tax COMMISSIONER OF…