Archives for GST portal

FAQs on payment on voluntary basis

Following are the general FAQs on payment on the voluntary basis 1. What is the facility for Payment on Voluntary Basis? Payment on Voluntary Basis is a facility given to…

Features of Special drive Refund Fortnight by Governments

Second "Special drive Refund Fortnight" will be started by Government from 31st May 2018 to 14th June 2018. In the press release made by Ministry of Finance, it has been…

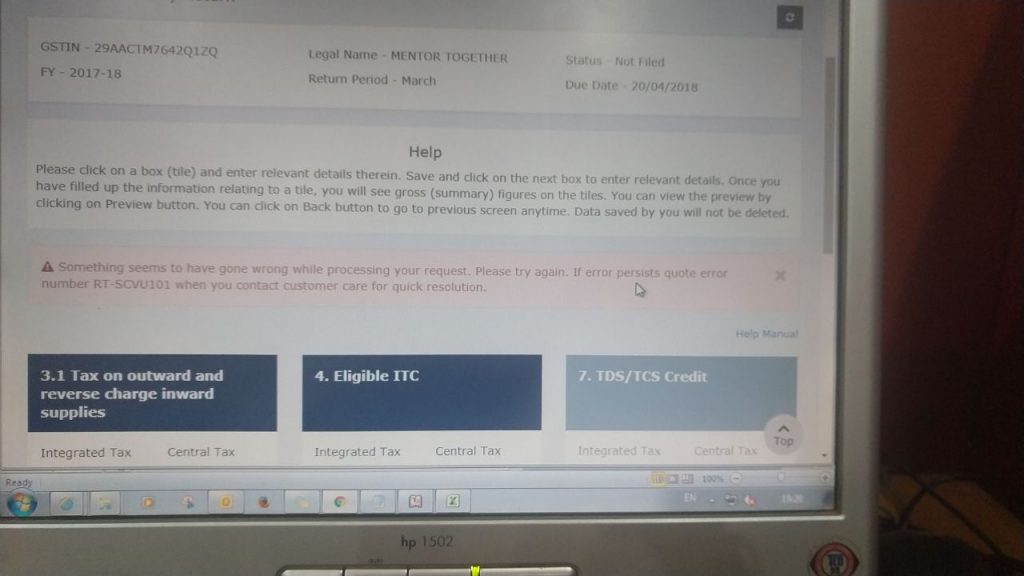

Error RT-SCVU101

error RT-SCVU101 Taxpayers have been facing Error RT-SCVU101 while saving the data in FORM GSTR3B. Error reads out Something seems to have gone wrong while processing your request. Please try again.…

Monthly GSTR1 return filing

CBEC has notified vide Notification No. 18/2018 – Central Tax the date to file the monthly GSTR1 for the period April to June. Registered persons having an aggregate turnover of more than…

Filing of Quarterly GSTR1 from April to June

CBEC has notified vide Notification No. 17/2018 – Central Tax the date to file the quarterly GSTR1 for the period April to June to be 31 July 2018. Previously, it was…

Letter of Undertaking can be furnished online

Letter of Undertaking (LUT) can now be furnished online in Form GST RFD 11 on GST portal to supply goods or services for export without payment of integrated tax. IGST…

NET ITC Provided is not equal to ITC Available RET3B91404

NET ITC Provided is not equal to ITC Available - ITC Reversed. If error persists quote Error Number RET3B91404 GSTN has now simplified the GSTR3B filing process wherein the submit…

How to generate E-way bill for multiple invoices

Question - Supplier issued multiple invoices to the consignee for delivery of goods. How to generate E-way bill for multiple invoices in such case? Answer - If the consignor has…

What to do when consignee refuses to accept the goods

What to do when consignee refuses to accept the goods Question - It might happen that the consignee refuses to accept the goods due to quality or any other reason.…

Refund of IGST amount paid on exports not received

Many taxpayers have been complaining of not receiving the refund of IGST amount paid on exports. So, what is the possible solution for that? The one possible reason for this…